Data

Data you can trust

As the pace of global change accelerates, we constantly iterat our technology to improve access to our data. So, whether you integrate data into your systems with our API or use the CRU DataLab analytics platform, you can extract maximum value from CRU’s standardisation of data.

Our commitment to providing quality data ensures you have the insights needed to make informed decisions and stay ahead in ever-evolving commodities markets. Partner with us and experience standardisation of data that works for you, enabling your success across your operations.

Flexible delivery options to fit your workflow

Access and customise CRU’s data the way you want

- CRU DataLab for interactive analysis and visualisation

- API integration for seamless data feeds into your systems

- Excel plug-ins for faster insight

- CRU Asset Platform for web-based benchmarking and scenario planning

Whether you're a trader, analyst or strategic decision-maker, our data quality and delivery options empower you to work smarter.

Turn data quality into decisions

- Benchmark prices, indexes and market trends

- Identify supply and demand gaps

- Evaluate asset performance in terms of costs and emissions

- Support ESG reporting and compliance

- Forecast global macro and commodity trends

Why CRU?

- 50+ years of industry leadership

- Expert transparent methodologies and proprietary models

- Independent and unbiased market analysis

- Trusted by governments, Fortune 500s and institutional investors

Learn more about CRU Data

Prices and Indices

We offer comprehensive commodity prices coverage across various sectors including steel, aluminium, battery materials, base metals, fertilizers and optical . . .

Learn More

Supply and Demand

We provide you with crucial consumption, production, capacity, trade, market balance and inventory data across the mining, metals, fertilizer and battery value chains.

Learn More

Asset Data: Supply, Costs, Emissions and Valuations

Our detailed insights into costs, production, emissions performance and valuations empower you to make informed decisions and drive your business forward.

Learn More

Macroeconomic and End-use Demand and Cost Drivers

International macroeconomic analysis empowering your decision making. CRU’s macroeconomic analysis enables you to make informed choices, mitigate risks, and seize opportunities across the global commodities markets

Learn More

Sustainability and Emissions

CRU’s Sustainability Service offers insights on the sustainability value chain, emissions trends, carbon markets and the costs of renewable and alternative energy sources

Learn More

Related solutions

Discover how our Solutions enable you to unlock the power of robust, accurate, and seamless commodities data in context with insight, and help you stay ahead in these evolving markets.

Asset Services

Learn More

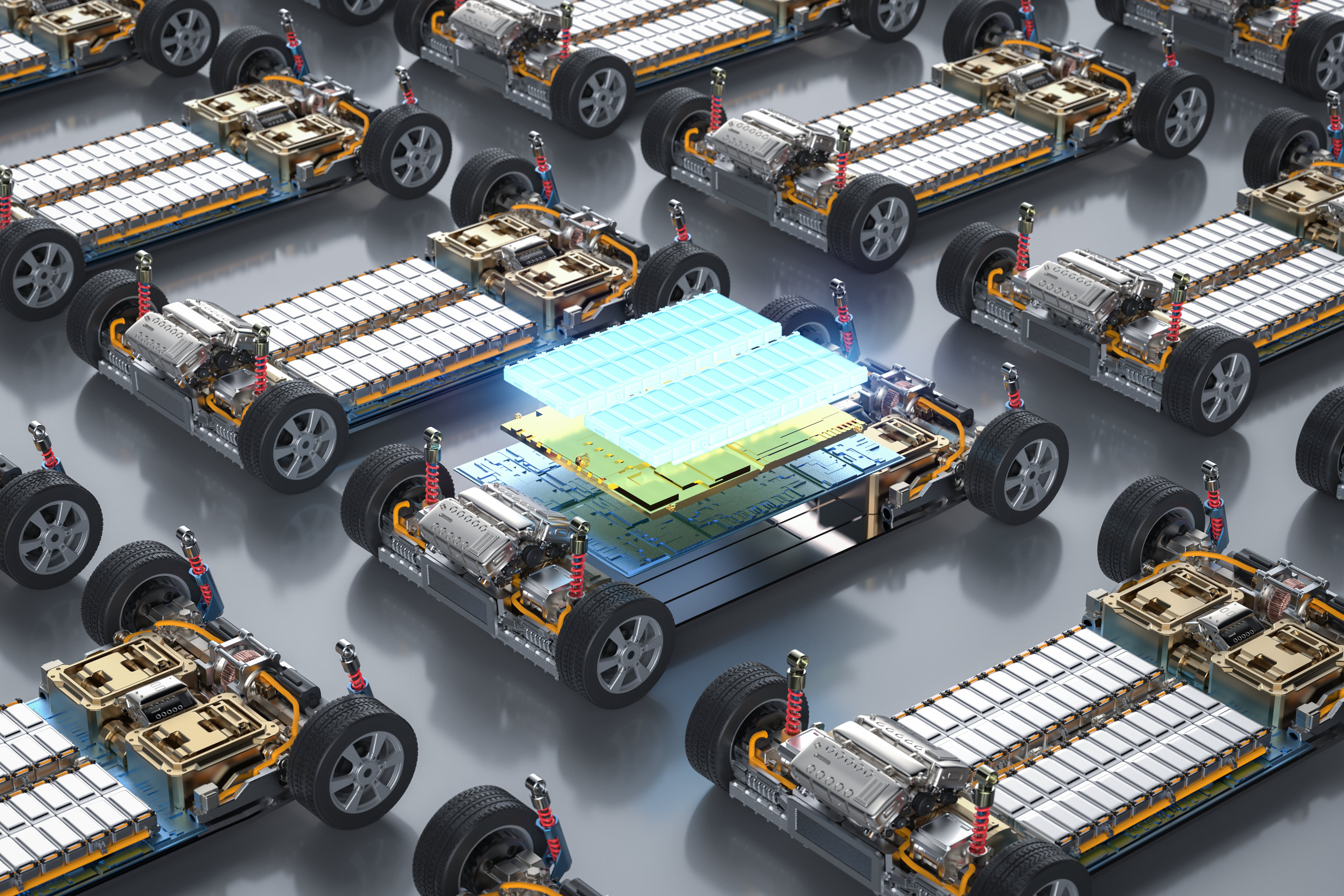

Battery Technology and Cost Model

Learn More

Copper Smelting and Refining Asset Service

Learn More

Cost Services

Learn More

CRU DataLab

Learn More

Emissions Services

Learn More

Energy Storage Technology and Cost Service

Learn More

Fertilizer Services

Learn More

Lithium Asset Service

Learn More

Low Emissions Hydrogen and Ammonia

Learn More

Power Transition Service

Learn More

Solar Technology and Cost Service

Learn More

Specialty Phosphate Service

Learn More

Sustainability and Emissions Service

Learn More