With the world on the brink of a major new era in information and communications technology, CRU organized its 3rd World Optical Fibre & Cable Conference in Wuhan, China on 1st-3rd November. Over 700 attendees gathered to discuss opportunities and challenges in the optical fibre and cable industry.

Chinese companies shared their optimism about future industrial developments and stated that 5G will provide an important boost to optical cable demand in the medium term.

Major players gathered in the Optics Valley of China

For the last three years, this conference has been organized by CRU in collaboration with YOFC, which has served as host and helped with program development, on-site logistics, and other support. This year’s event also was hosted by the Wuhan East Lake Develop Zone, also known as the “Optics Valley” of China.

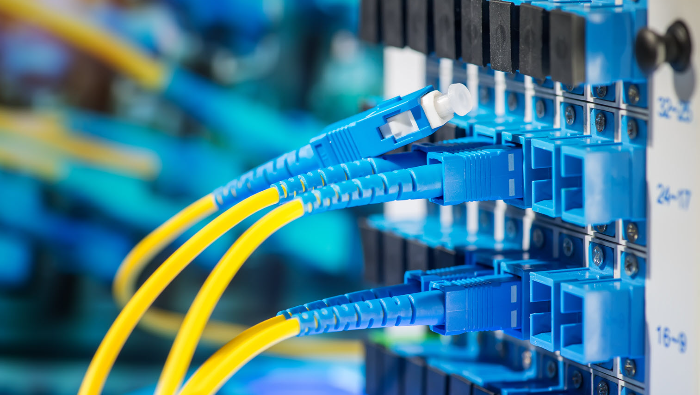

The conference was an opportunity to bring together in Wuhan's Optics Valley the world’s leading producers of optical fibre and cable as well as the key suppliers of preforms, manufacturing equipment, and many other players from the optical cable and networking supply chains.

In recent years, China has gained a major role in the world’s fibre optic and telecom markets: China accounts for 57% of the world’s optical consumption; it also accounts for 57% of the world’s FTTx subscribers.

Within China, Wuhan is a key region for fibre optics and other advanced technologies. Wuhan has several technology parks, with a total of eight planned. Wuhan also has 42 universities, including several with advanced telecom and optics programs. Many of China’s top telecom and optical companies have headquarters or large facilities in Wuhan, including YOFC, FiberHome, and other companies focusing on lasers, displays, imaging, and energy.

Over three days, conference participants had the opportunity to focus on major developments affecting optical network concepts, product requirements, and manufacturing capabilities. Participants also had the chance to visit YOFC’s fibre and cable production facilties and to attend the Optics Valley of China Expo, which displayed optics and advanced technologies for communications, imaging, machine vision, and other areas.

Optical cable continues to boom in China

The three day event provided information on a wide choice of fibre-related topics including global market prospects, the latest insights on government programmes, infrastructure modernisation, major consumption trends, new supply dynamics, and fibre and cable manufacturing process improvements. A common theme in the different presentations delivered during the CRU conference was the impact of 5G network construction on optical cable demand during the next few years.

In China, Ministry-level policies are promoting the construction of 5G networks. The goal is to have 5G technology support the rapid development of the IoT, artifical intelligence, big data, cloud computing, education, health care, smart-city functions, and consumer communications, especially video.

During a keynote speech, Mr Wei Leping, Director of China Telecom’s Science and Technology Committee, mentioned that China’s investment in 5G networks will total US$ 411 billion, over a 10-year period from 2020 to 2030. This investment figure is 3.5 times higher than that of the country’s total investment in 4G networks. In addition, Mr. Wei reported that the expansion and the improvement of optical fibre infrastructure will be necessary for 5G to meet its key criteria.

Executives from China’s top five cable manufacturers all expressed optimism in a keynote session covering the market outlook. Mr Zhuang from YOFC and Mr Qian from Hengtong believe that demand for optical cable will grow at rates of 5-10% in the next five years. Mr Hua from Futong expressed concern about capacity expansions at major fibre makers’ within the next couple of years. Although demand for optical cable is strong, current levels of investment could result in overcapacity and create fierce competition in the market. For this reason, Mr Hua called for companies to focus on automation and efficiency, rather than capacity additions.

The amount of optical cable installed worldwide in the first three quarters of 2017 totalled 359 million fibre-km, a 12% y-o-y increase. China’s consumption was 206 million fibre-km through to the end of Q3 2017, putting China at 57% of the world market. CRU’s market surveys show Chinese suppliers believe fibre and cable orders in H2 are stronger than in H1 2017. China’s full-year total could be 280 million fibre-km or more.