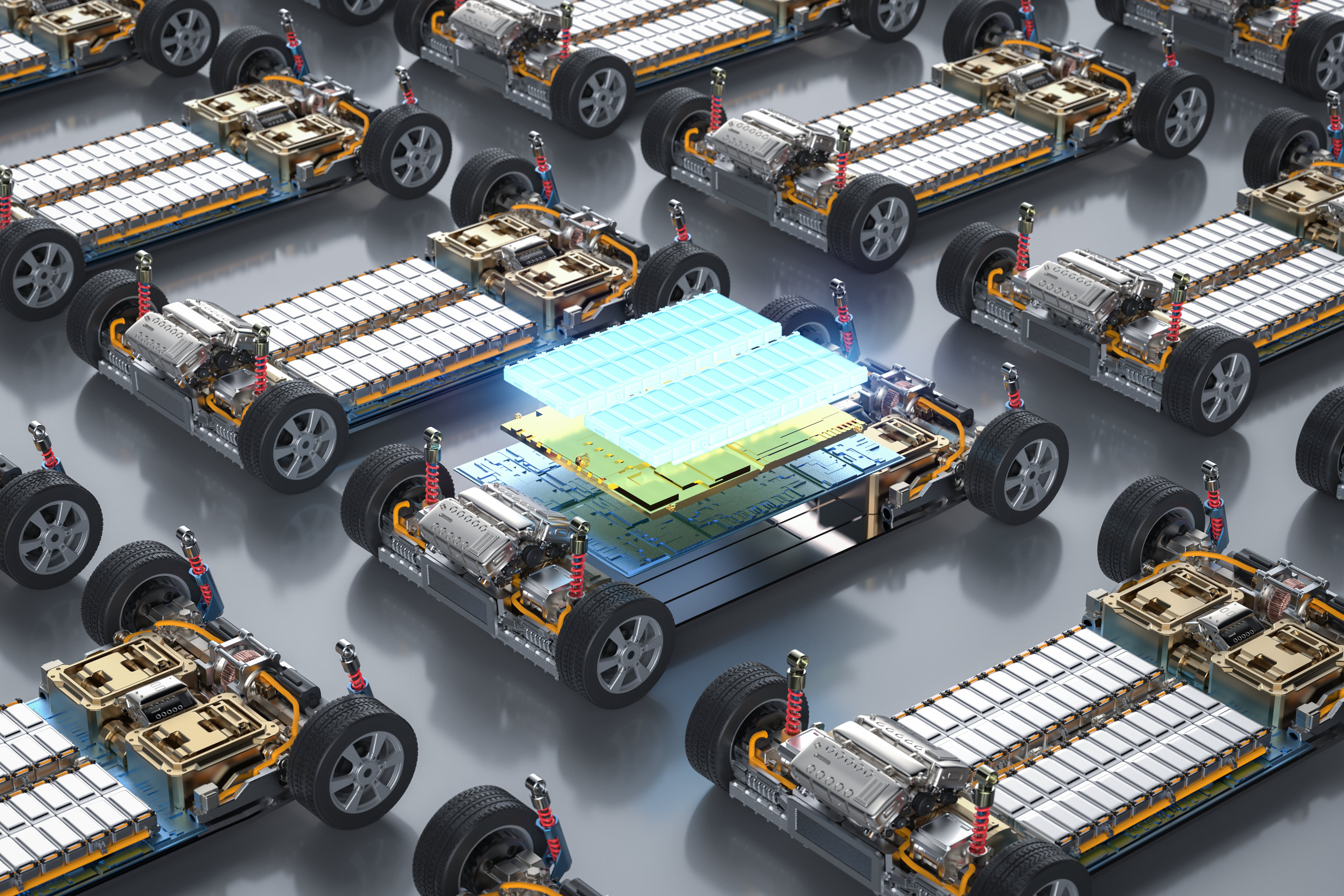

This Insight focuses on current nickel use in the battery sector, how it has changed in recent years, what is driving these changes and what our base case demand forecasts for nickel are.

CRU calculates that around 5% of nickel demand came from the battery sector in 2019. However, we forecast that growth will be rapid and the battery sectors use of primary nickel will reach 870,000 tonnes by 2030 and 1.5 Mt by 2040. The evolution of the electric vehicle sector and the differing battery technologies within it, will increasingly shape the nickel market and represent a third of total demand by 2040.

There has been fierce debate surrounding the outlook for nickel usage in lithium batteries over the past few years. CRU has invested a large amount of time and resources into developing in-house long-term modelling capabilities for the automotive sector. This work has been undertaken not only to support our analysis of traditional automotive commodities like steel and aluminium, but also to shed light on the development and growth of the nascent electric vehicle (EV) sector and to better understand the resultant long-term impact for a wide range of commodities including cobalt, lithium, nickel, graphite and PGMs.

Of the various battery chemistries in widespread production four use nickel: nickel metal hydride (NiMH), nickel cadmium (NiCd), nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminium oxide (NCA). Here, we will focus on NMC and NCA, which amount to more than 95% of nickel contained in batteries. NMC and NCA are lithium-ion batteries (LIBs), but NiMH and NiCd are not and we believe more applications will move towards using LIBs in the future.

Sourcing of nickel units for cathode markets shows high degree of flexibility

CRU’s in-house nickel sulphate supply model covers nine separate key processing routes. These can be classified into four categories, based on the raw materials used; sulphide ore, nickel briquettes, laterite ore and recycled nickel. Currently, sulphide ore, nickel briquettes are the dominate routes, but laterite ore and recycled nickel are growing.

During the rapid growth in China’s EV market in 2018, sulphate products that were dissolved from briquettes played a central role in feeding the market. In 2018, we believe that the vast majority of China’s southern precursor/cathode makers sourced some of their nickel directly from metal, a step change from earlier years.

An illustrative example of the changing nature of Chinese cathode producer flexibility is shown below. Our feedback from a major cathode producer shows that their supply chain reacted extremely rapidly, with their feed changing from being close to 80% sulphate fed in 2016 to only 15% sulphate fed during 2018.

This change was driven by the spread between metal and sulphates. Sulphate premiums fluctuated around $3,000 /t on a metal contained basis. Moreover, at their peak they were over $4,000 /t. However, the premiums collapsed from H2 2019 due to disappointing China EV sales and strong speculations in the nickel metal markets. The fall in the spreads between metal and sulphate has meant that it is again more economical for end users to buy sulphate directly. CRU understands that the contract negotiations for 2020 between cathode makers and briquettes marketers are difficult as the premiums declined. Users would probably source more sulphate in the first half this year given that we expect EV sales won’t pick up soon.

Where will supply come from?

With the expected strong demand growth for nickel from the battery sector, a number of HPAL (High-Pressure Acid Leaching) projects are under construction in Indonesia, which use laterite ore as feedstocks. A large part of this will require more HPAL capacity to be built, which, based on past performance, looks inherently risky. CRU is tracking these new developments closely; we detail these further in the Long Term Nickel Market Outlook.

- PT Halmahera Persada Lygen, a joint venture between Harita group and Ningbo Lygend investment, is building a HPAL plant in Obi Island. It is the first HPAL project in Indonesia and aims to get committed by second half of 2020. CRU understands that the first 850 tonne autoclave was installed at the end of 2019. Phase I will have a capacity of 36,000 tonne per year (t/y) nickel and 4,400 t/y cobalt.

- PT Huayue Nickel Cobalt, a joint venture between Huayou cobalt (57%), CMOC (30%), Tsingshan (10%) and others (3%), is constructing a 60,000 t/y nickel contained MHP HPAL facility in Morowali. The register capital after CMOC’s entering in September 2019 will be raised to 260 million from 50 million dollars.

- QMB New Energy Materials also announced that it is to build a HPAL facility to produce at least 50,00 t/y of nickel and 4,000 t/y of cobalt (both contained) at Tsingshan’s industrial park in Morowali on the island of Sulawesi.

Recycled sulphate is becoming increasingly popular and more companies are looking at the battery recycling sector. CRU believes it will take time for this sector to develop and for enough LIB batteries to reach their end of life. However, some recyclers are increasingly making sulphate by using industrial wastes. We see some growth from this sector with companies such as Grand Green Technology, whose productions of nickel sulphate tripled from 2,476 tons in 2017 to 7,508 tons in 2019. Overall, the growth in secondary supply will be a key question for the nickel market and will grow in importance as the current EV fleet, particularly in China, ages and reaches the end of its life.<''>Calculating the volume of nickel in batteries is another hot topic in the market. We estimate that only about 117,000 t of nickel was used by the battery sector globally in 2019. Currently, NCM 523 dominates all kinds of ternary cathodes, with EVs growing significantly as a proportion of the overall LIB market. Currently, NCM 811 and LCO represent a smaller proportion of the market.

Could the future for nickel demand be electric?

We forecast that the future for nickel use in batteries is bright. This growth is driven by increasing EV sales, particularly in China, enlarging battery size and raising nickel intensities. CRU believes that the share of NCA and NCM in in battery cathode will grow to 84% by 2030. Batteries will represent 23.7% of the nickel demand by 2030 and 33% by 2040.

The growth in nickel demand in the long-term is dependent on increasing market share of electric vehicles in the transport sector using nickel-intensive batteries. We forecast around two thirds of nickel demand growth out to 2040 will come from the battery sector. In short, the outlook for the health and investment need in the nickel market is increasingly being tied to the outlook for EVs.