Mexico has historically relied on steel sheet product imports to meet its demand as domestic suppliers, such as Ternium and AHMSA, had insufficient production capacity. But, in recent years, both Ternium and ArcelorMittal have built new capacities for HR coil in Mexico. Ternium is also in the process of building more downstream capacity and recently announced investments in crude steel and DRI capacity. In our view, Mexican sheet products capacity and production will grow further to continue replacing imports. For some products like HR coil, production will outpace domestic demand and Mexico will become a net exporter.

In this Insight we explore the following topics:

- Recently added capacity

- Trade

- Future trends in consumption

- Future capacities

Ternium and ArcelorMittal started up new HR coil capacities in 2021

Ternium announced, in 2017, the built of a new hot rolling mill in its Pesquería plant with capacity of 4.4 Mt/y. The rolling mill started operation in June 2021 and reached its first million tonnes of production in January 2022.

ArcelorMittal announced, in 2018, it would build a new hot strip mill (HSM) in its Lázaro Cárdenas plant with capacity of 2.5 Mt/y. Before that, the plant was dedicated to the production of slabs that were sold domestically and exported. Lázaro Cárdenas’ first hot rolled coil was manufactured in December 2021 and the plant started continuous production in January 2022. ArcelorMittal mentioned in its 2022 Q4 earnings call that the new HSM is running at about 50% utilisation and will continue the ramp up to reach full capacity in late 2023.

With these two new plants, the installed capacity of HR coil in Mexico increased by 6.9 Mt/y, or 73% (see chart), to reach 16.4 Mt/y in 2021. As these capacities were ramping up in 2022, we should see the full increase in production in 2023.

Ternium to build a new EAF in North America

Ternium recently announced it is planning to add new slab capacity in North America. The plant will consist of an EAF with capacity of 2.6 Mt/y, a DRI module with capacity of 2.1 Mt/y, and a slab caster. The company expects to commission the facilities in 2026 H1, with the exact location still under analysis and to be announced soon.

This plant will enable Ternium to produce more high-quality slab and steels in Mexico, like those required by the automotive industry, and it will be USMCA-compliant. Together with the slab production in Brazil, the new plant will allow the company to be almost selfsufficient in slabs when running at full capacity in the Mexican rolling operations.

Less imports, more exports

As the ramp up of the new capacities happened during 2022, we have seen only part of the effects the extra production will have on the market. Nevertheless, some trajectory changes started to show up last year.

In the pre-pandemic period of 2017–2019, Mexico imported on average 1.86 Mt/y of HR coil and exported 0.19 Mt/y. In 2022, we estimate Mexico imported a total of 1.19 Mt/y, a decrease of 36% over the historical average, and exported 0.23 Mt, an increase of 21%.

With the new capacities, Mexico will have excess HR coil supply that will need to be exported or processed further. The latter would allow Mexico to replace imports in other product segments, such as CR coil, in which there still is a strong dependency on imports.

We expect Mexico to become a net exporter of HR coil, starting from 2023. In the case of no further downstream investments, this net exporter position will increase rapidly throughout our five-year forecast period. A risk to this forecast is related to AHMSA’s production level, which has trended downwards in the last few years and is fully idled right now.

AHMSA stopped production

AHMSA production has been idled since December 2022 due to an economic crisis. The company is a relevant sheet producer in Mexico, having capacity to produce 2.7 Mt/y of HR coil, 1.0 Mt/y of CR coil, and 1.6 Mt/y of plate products. The stoppage has been impacting the domestic supply of all these products. Therefore, only when AHMSA comes back to the market, will we be able to observe the full influence of the new HR coil capacities in the market.

It was just announced an agreement to sell the majority of shares to a group of foreign investors to recapitalise the company. The investors will need to inject $50 million in the next 15 days and another $150 million by mid-May as working capital, to normalise labour responsibilities and operations in the steel mills and mines.

Future trends in consumption

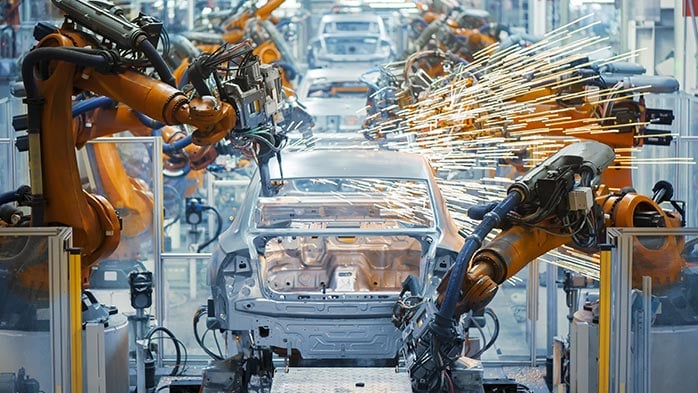

We forecast increasing sheet demand in Mexico for the coming years, mainly supported by growth in the automotive industry. Our Economics team projects consistent growth for the Mexican economy until 2027. In addition to that, the market expects further support for steel demand coming from nearshoring of US steel-intensive manufacturing to Mexico.

We expect demand growth for all the main sheet products: HR coil, CR coil, galvanised and tinplate (see chart). This will be in line with the growth of automotive and construction output, as well as GDP and IP expansions. We expect the automotive sector to grow faster than other sectors and the overall economy until 2025, and this will give support for sheet demand growth.

CRU expects more capacity to start in the future

With the extra HR coil capacity in Mexico, we expect most HR coil imports will be replaced, exports will increase, and further processing into more value-added products will occur.

Ternium has already announced it will invest in more downstream capacity. The company will expand the new production facility at Pesquería to include a 0.5 Mt/y pickling line and new finishing lines, which will be commissioned by mid-2024; and, a 1.6 Mt/y pickling line and tandem cold mill (PLTCM), and a 0.6 Mt/y galvanising line, which are expected to start operation by the end of 2025.

There are rumours that ArcelorMittal will build a pickling line in Lázaro Cárdenas to start up in the end of 2024 and that the company is analysing investments to elevate the HR coil capacity from 2.5 to 4.5 Mt/y. According to company information, the current focus is to produce 5.3 Mt of steel in Mexico the short term, including HR coil, slab, and long products and to increase the vertical integration with its local mining operations.

Looking at Mexican sheet products net export figures, we can see a shortage of CR coil in the domestic market. In 2022, we estimate CR coil net imports increased by 11% versus the 2017–2019 average, to reach around 1.4 Mt. Ternium’s new PLTCM, with capacity of 1.5 Mt/y, has the potential to replace part of these imports. Mexico also imports galvanised sheet, and we estimate imports totalled 1.1 Mt in 2022. However, no new capacity would be necessary to reduce galvanised imports as capacity utilisation has been low, at around 60%, so increasing it would be sufficient to replace imports. Nevertheless, to do so, more domestic or imported CR coil substrate would be needed.

In conclusion, we expect Mexican sheet products end-use demand to increase on the back of growing automotive output and nearshoring strategies from US companies. The recently added HR coil capacity in Mexico will change the country’s position from a net importer to a net exporter in the coming years. Meanwhile, CR coil capacity will be required to fully replace imports and fulfil galvanising requirements. So far, announced investments in CR coil capacity would not be sufficient to reverse the country's net importing position of CR and HDG coil.