Growth in Indian steel output is expected to outpace that of domestic demand in 2024 – more so for flats than for longs. Hence, mill stocks may rise beyond current highs, squeezing margins, as export sales are not expected to increase sharply.

Jittery demand outlook for 2024 due to general elections

2023 has been a healthy year for Indian steel market, with CRU forecasting a 7% y/y growth in domestic consumption. The key driver for this growth has been the strong construction activity aided by higher related public expenditure, although private sector investment growth has been relatively modest. The government has increased capital expenditure (or capex) prior to the upcoming general elections in mid-2024 and, hence, facilitated growth in steel consumption.

This government capex-led steel demand growth is not expected to sustain in 2024, particularly during 2024 H1 because of an expected reduction in government construction spending during the 2024 general elections. This will cause longs demand to reduce y/y, particularly during H1 (see chart below). Nevertheless, manufacturing activity is expected to stay resilient and keep supporting demand for flat steel, although at a slower pace than in 2023.

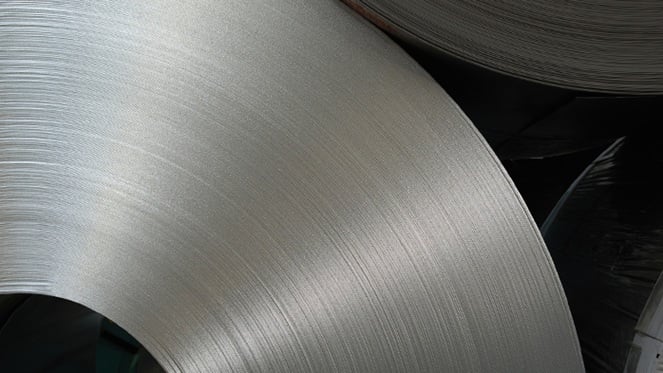

Supply growth will outpace demand, causing rise in stocks

While demand is expected to register a modest growth in 2024, the same is not true for supply – more so for flats than for longs. The Indian steelmaking industry is currently in the midst of significant capacity expansions, some of which are coming on stream or ramping up in 2024. The fact that most of this incremental capacity is being added through the BF-BOF based steelmaking route means that output cuts in a low demand scenario will be very limited or very expensive. A slower ramp-up of the already commissioned plants and a delay in commissioning of other plants can help ease some of the supply pressures.

We do not expect a significant increase in Indian exports in 2024 due to intense price competition and shift in preference among some importers towards low-emissions steel. Therefore, Indian domestic steel inventory is expected to rise from current levels (see chart below) and put added supply side pressure on domestic prices – particularly for flat steel products. Steelmakers will need to explore new strategies to boost exports and manage excessive stocks.

Producers of steel longs are better positioned to control stocks vis-à-vis flat steel producers. This is because most of Indian longs output is through the electric arc furnace and induction furnace (EAF/IF)-based steelmaking routes, allowing higher flexibility in managing output. Therefore, despite a projected lower demand growth for longs compared to flats in 2024, supply-demand dynamics are expected to be more balanced for longs than flats during the year. Nevertheless, longs inventory of BF-BOF based mills is also at risk of growing in 2024 because of reduced project sales and strong price competition from EAF/IF mills in the spot market.