Reader View of the Infographic

This text version mirrored from the content presented in our infographic to provide you with smooth accessibility and effortless reading. Feel free to navigate this text version to comprehensively grasp the insights encapsulated in the original infographic.

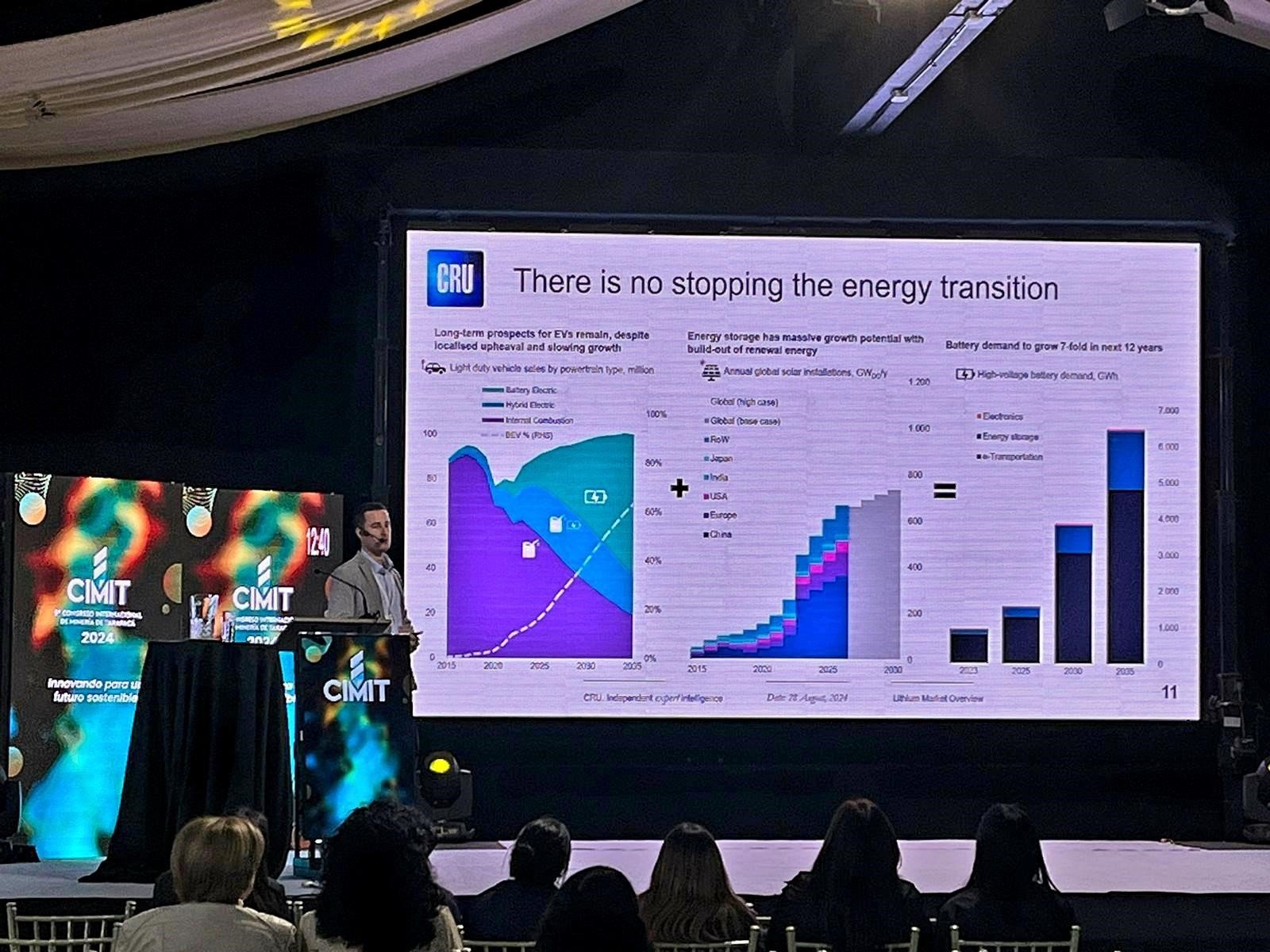

China will remain the EV powerhouse, but other regions will narrow the gap as their EV production bases ramp up.

Build where you sell

Trade flows will be dampened by the impetus to localise vehicle and battery production to where they are sold. Import tariffs in the major regions can be as high as 27%. Policies such as the Inflation Reduction Act provide incentives for domestically produced vehicles and batteries. Nations are racing to onshore manufacturing to maintain economic competitiveness, through policy and financial support.

Chinese brands: rapid expansion and market disruption

Chinese automakers are expanding beyond their home market, empowered by policy support, technical and cost advantages, and command of the battery supply chain. You may read our prior insight here.

Most exports have been from western brands farming out production to China, but Chinese brands will surpass them. Exports are just one piece of the picture. Some Chinese automakers are in early stages of localising production in Europe and South Asia. Western manufacturers have reasons for optimism. Chinese innovators are spurring the rest of the industry to improve offerings and adopt similar design philosophies and operating practices.

Ultimately, the prerequisite to a region's leadership in EVs is command of the battery supply chain.