We expect the Chinese economy to grow 5.2% in 2023, beating the 5% target set at the Two Sessions meeting. While this is a moderate growth rate relative to China’s long-run average, it is a significant acceleration from the 3% China recorded in 2022. This acceleration will have benefits for the world economy, but also costs. The net benefits will vary across different countries and regions. Our China re-opening Heatmap (Figure 1) visualises this for some key economies. Countries in East and Southeast Asia have the biggest potential for upside, but may also face stronger inflationary pressures.

We expect stronger Chinese GDP growth to fuel a turnaround in Chinese demand for imports, supporting export demand for other countries. Imports tend to be cyclical and rise more quickly than GDP as a whole, during the recovery phase (Figure 2).

As shown in the first column of our Heatmap, this should particularly benefit economies in East and Southeast Asia, which have strong trade links with China. Many of these countries – particularly Thailand – are also well placed to benefit from a pick-up in Chinese outward tourism. However, it is worth noting that a significant part of their exports to China are intermediate products which are used as inputs to Chinese exports. Global final demand is the real driver of these.

Many commodity producers also export heavily to China. However, we expect this acceleration in growth to be led by consumer demand and the service sector, rather than infrastructure spending and construction. This means China’s acceleration in growth may create less demand for commodities than in previous upswings – for example following the Great Financial Crisis.

Europe has less upside from Chinese growth. Even in Germany – by far the largest European exporter to China – exports to China account for only 2.8% of GDP (Figure 1). The acceleration in Chinese import demand shown in Figure 2 would directly boost German GDP by around 0.3 ppt in 2023 – useful, but not transformational.

There will also be costs for other economies. Stronger domestic demand in China will also be inflationary for the world. In 2022, the combination of China’s restrictive zero-Covid policies and continued weakness in the real estate market kept domestic demand very weak. This outweighed the supply-chain disruptions caused by Covid-19 restrictions, and meant China was a deflationary force in the world economy. Chinese PPI inflation has dropped from a peak of 13.5% in October 2021 to -1.4% in February 2023 (Figure 3, left-hand side), and CPI inflation remained far below Western levels.

With domestic demand returning, at some point China may flip to exporting inflation. Countries with high imports from China will be exposed to higher imported inflation. The second column of the Heatmap (Figure 1) shows how countries rank on this exposure. Although East and Southeast Asian countries rank highly on this exposure, much of their imports from China are intermediate products that go into exports – for example, components for solar panels assembled in Vietnam which are then shipped to the US. In these cases, the real economic exposure will lie further away.

However, it is likely to take some time before stronger Chinese domestic demand translates into cost pressures for finished and intermediate goods, as there should be spare capacity in the Chinese economy after weak growth in 2022. Directly exported inflation is likely to be more of an issue in 2024.

A more immediate way in which China may add to global inflationary pressures is through commodity prices. Weak Chinese energy demand helped to keep oil prices low in late 2022, despite concerns over Russian supply. As China re-opens, it is likely to demand more energy. So far, there has been little apparent response in oil prices (Figure 3, right-hand side), and gas prices have continued to fall. However, it is early days and we have not seen China’s re-opening lead to significantly increased energy demand in the data – yet. A renewed surge in energy prices would have a negative impact on net energy importers such as Japan and the Eurozone, but would of course benefit large energy producers such as Canada or the Gulf states.

Overall, the acceleration in Chinese growth we expect this year will be positive for world growth, but will not benefit all countries equally.

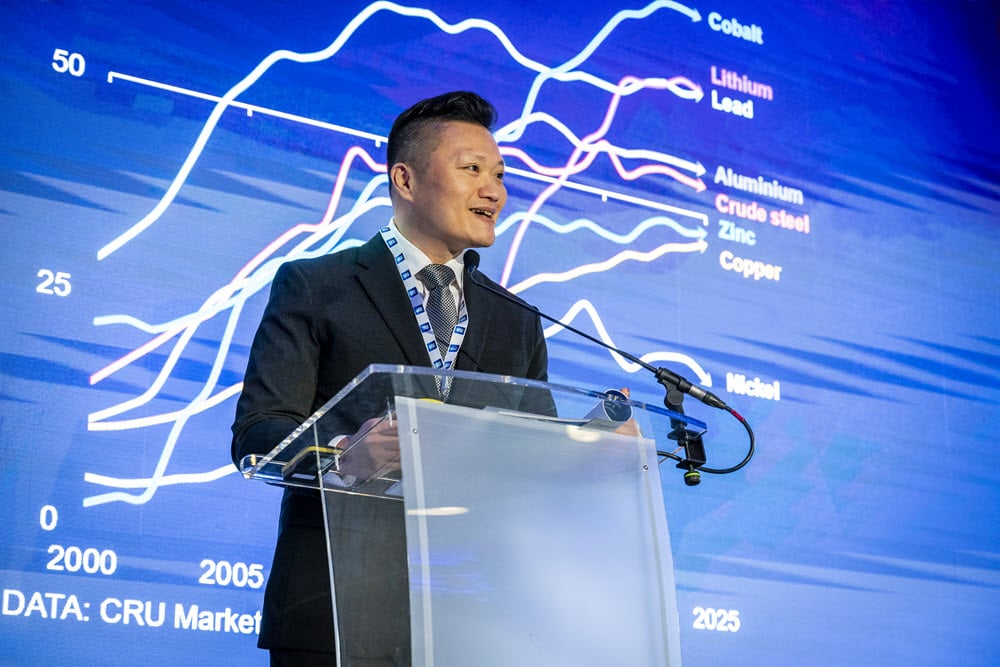

These and other economic developments that impact commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. Experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to discuss markets one month on from the invasion of Ukraine. The webinar is available to watch on-demand here.