Reports of the death of stainless steel in the automotive sector may have been greatly exaggerated. Currently, stainless steel mostly finds a use in ICE exhaust systems, but with greater EV adoption, future demand for this material from the automotive sector is under threat. Yet one vehicle might be about to buck the trend – the Tesla Cybertruck.

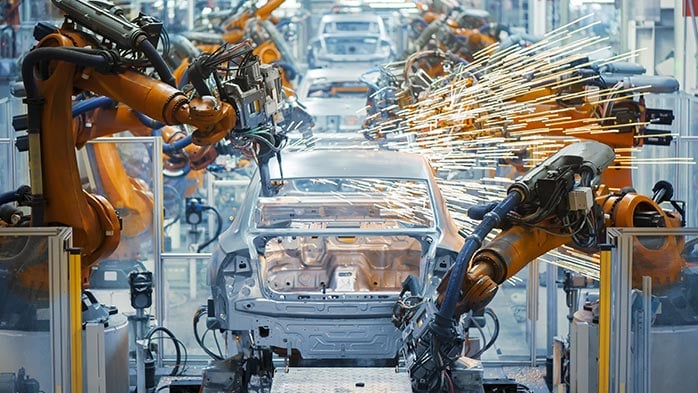

Last Thursday, the first batch of the much-anticipated pick-up truck was delivered to a select number of customers by Elon Musk in Austin, Texas – an event closely watched by automotive enthusiasts and the media. Much has been made of the vehicle’s unconventional design, perhaps especially its unique use of stainless steel panels in the outer body. With the design finalised, production started, and the truck finally being rolled out to customers, what will this mean for stainless demand in the United States?

Here we quantify the Cybertuck’s impact on stainless demand. Should production go to plan, this could be a big deal for stainless steel. However, a slow ramp-up of production for this new vehicle will likely prevent this from happening.

The future looks austenitic

Tesla is no stranger to innovation. This new vehicle’s most unique feature, beyond its futuristic look, relates to the material of choice for the outer body. The Cybertruck’s panels are in fact an austenitic stainless steel alloy, described as Ultra-Hard 30X Cold-Rolled stainless-steel. The blend is proprietary to Tesla, but the 30X nomenclature suggests an alloy variant of the nickel-containing 300-series stainless steel. Speculation on the closest equivalent has ranged from 301 to 305 or 306-grades, but Musk has indicated that the stainless material will be the same as the Space X Starship shell, namely 304L.

Using austenitics has only been attempted a handful of times. “Finally, the future will look like the future”, declared Musk at the delivery event – but it also looks a bit like the past. The iconic DMC DeLorean, featured in the 1980s Back To The Future film, used 304-grade alloy. Other rare examples also exist. Today, the stainless used in cars is 400-series ferritic grade in ICE exhaust systems. Ferritic grades do not contain nickel, making them less expensive than their austenitic counterparts.

Production is key

Much hype surrounds the truck, meaning demand is not a problem, with over a million pre-orders already placed. But Tesla faces huge challenges with ramping up production of its first all-electric pickup truck. Indeed, behind the many delays in delivery, since its unveiling four years ago, lie the vehicle’s innovative features and the choice of stainless steel.

Tesla is chasing an annual run rate of 250,000 units for the Cybertruck by 2025. By Elon Musk’s own admission, however, achieving this target seems highly unlikely, as the use of stainless steel for the vehicle’s outer panels upends manufacturing norms. CRU’s automotive team has a more conservative forecast for Cybertruck production volumes, predicting just over 59,000 units in 2025. Which output projection ends up being correct makes a huge difference for stainless demand.

It all comes down to weight

With weight saving being a key aim in EV development, the use of stainless steel may not seem the obvious choice, due to its higher density compared to carbon steel. Nevertheless, the Cybertruck comes with a curb weight of less than 3 tonnes. Even the Cyberbeast version weighs in at only 3.1 tonnes, lighter than the Rivian R1T, but heavier than the Ford F-150 Lightning – though the latter has an aluminium body. Some of the weight saving comes from the Cybertruck’s unique body structure, which Tesla calls an “Exoskeleton”. This is substantially different from a traditional body-on-frame structure, and somewhat closer to a unibody. Having no chassis or power train helps with weight reduction but on the flipside, the stainless steel “bullet-proof” outer panels are a hefty 3 mm thick.

So what does this all mean for stainless demand?

According to CRU’s November edition of the Stainless Steel Flat Products Market Outlook, apparent consumption of cold-rolled stainless steel in the US will be 1.34 Mt in 2025. Apparent consumption is the steel industry’s preferred measure of demand. Our consumption forecast has not yet factored in the additional demand that will come from the Cybertruck. So how much more stainless steel will be needed from the Cybertruck is key to understanding the sector’s growth trajectory.

Here are three possible scenarios:

- Scenario 1: Under the most bullish, but highly unlikely scenario, where a run-rate of 250,000 units is achieved early in 2025, the Cybertruck could have a significant impact on stainless demand in the US, adding a staggering 24%, or 320,000 tonnes to the market as soon as 2025. This increase in demand, attributed to the Cybertruck, is nearly the same as the combined apparent consumption in Canada and Mexico in 2023.

- Scenario 2: Even under a milder scenario where the production ramp-up progresses gradually to reach a run rate of 250,000 at the tail end of 2025, the impact would still be huge. In this event we calculate that the Cybertruck would add 17% (234,000 tonnes) to stainless demand in 2025, rising to 22% (313,000 tonnes) thereafter.

- Scenario 3: Our analysis suggests that at only 59,000 units per year, the Cybertruck will most likely add 6% in 2025, or 76,000 tonnes of new demand, to the US stainless steel market, falling slightly thereafter.

The Cybertruck therefore has the potential to be significant for stainless steel demand. But whether it will be or not, really depends on how aggressively production is scaled up. Evidence suggests this will not be an immediate game changer.