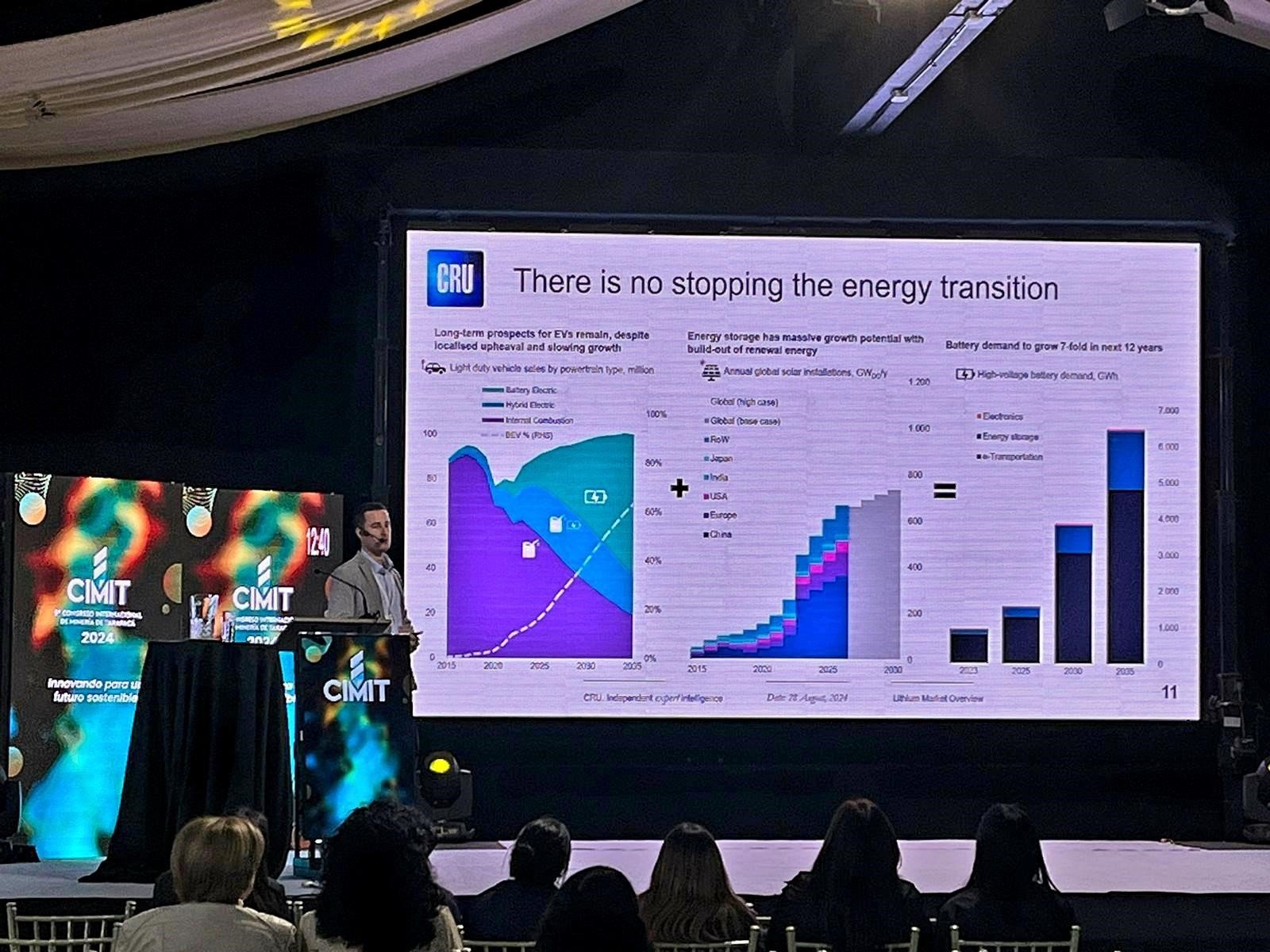

This insight article covers the pivotal trends and challenges confronting the battery market in 2024. Amid fluctuating metal prices and geopolitical shifts, the battery industry faces a critical juncture. From curtailed mining operations affecting lithium and cobalt supply to the strategic realignment of global supply chains away from China, we explore the multifaceted pressures reshaping the landscape. The piece also examines the potential impact of upcoming global elections on battery and electric vehicle (EV) policies, technological innovations poised to disrupt the market, and the evolving dynamics of investment and production. As the demand for batteries continues to grow, driven by the surge in EV adoption and renewable energy storage, understanding these trends is crucial for stakeholders across the value chain.

1. Curtailed mining operations

As battery metal prices continue to decrease heading into 2024, greater pressure is being placed on producers as their profit margins are eroded. The world’s largest lithium producers have already issued revised guidance for 2024, and the start of new capacity expansions are being delayed. If the trend of lower pricing persists as expected, more companies will be forced to reconsider their plans. At current prices, higher cost lithium producers in Zimbabwe, in addition to Chinese lepidolite operations, are already likely to be producing at a loss.

Nickel projects will be better protected against weak battery market fundamentals, given that battery demand only comprised 17% of primary consumption in 2023. Mines may still face cutbacks with oversupply mounting – the first indications of curtailments have already been announced from Australia. There are even concerns that Chinese investment into low-cost Indonesian projects will be stymied.

Although prices of cobalt sulphate are hovering around record lows, impactful cutbacks in production are unlikely to materialise. Smaller Ni-Co sulphide miners may be forced to rethink their plans, but cobalt producers in Indonesia and the DRC are unlikely to be deterred as long as they continue to enjoy healthy profits on nickel and copper.

2. Inventories along the supply chain to remain high

Inventories throughout the battery supply chain remained stubbornly high during 2023. CRU anticipates that battery raw materials supply will continue to outstrip demand in 2024, facilitating well-stocked raw materials inventories.

If companies are able to draw down their existing inventories over procuring new material, demand and prices will remain low. Although this will reduce manufacturing costs for downstream players, miners will increasingly struggle to turn a profit.

The battery cell industry in China is still struggling to drawdown substantial inventories built up from the end of 2022, and some manufacturers continue to overproduce battery cells. As a result, heavily discounted materials, batteries, and electric vehicles will eventually roll through to consumers, encouraging demand due to improved affordability.

3. Investment in midstream production will shift away from China

Another trend anticipated to continue in 2024 is the growth of World ex. China midstream production. Further investment decisions in midstream capacity will continue to be focused on South Korea, Canada, Morocco, and Europe.

Countries aiming to reduce their dependency on Chinese production will invest in and ramp up cathode and precursor projects. South Korea increased its cathode and precursor production by 35% y/y in 2023 and heavily reduced its imports from China as a result.

Chinese companies will also be a significant driver of global ex. China midstream production in 2024 as they look to comply with, or circumvent, adverse policies and trade tariffs. Chinese midstream producers will form joint ventures in Free Trade Agreement countries to make their material eligible for IRA tax credits. Often these companies are partnering with established Western and South Korean battery and EV OEMs.

Increasing cathode capacity outside of China will initiate a shift in regional raw material consumption, supporting greater premiums for battery chemicals in those regions compared to Chinese prices.

4. 2024 elections will shape battery and EV policy

In 2024, at least 64 countries are expected to hold elections, with half of the global population anticipated to vote. Some of these elections will occur in countries which are key to the battery value chain and will have significant implications for battery policy regardless of the outcomes.

The most prominent will be the US presidential race, which is set to conclude in November. Whether Joe Biden can secure a second term, or whether the Republican Party can make a comeback is yet to be seen. Nevertheless, both administrations would shape US battery and EV policy in contrasting ways.

Earlier in the year, the European Parliament elections will occur at a time when the EU is caught between supporting the fledgling European battery industry and cutting back financial incentives in the face of broader macroeconomic headwinds.

The Indonesian general election will also be one to watch as Joko Widodo, who has been instrumental in developing the country into a battery hub, is barred from running for a third term as president. The DRC elections late last year faced legal challenges and civil unrest, but did not result in any cobalt production impacts, as it has been the case in the past.

5. Declining electric vehicle subsidies

Government subsidies have been a staple in most major EV markets for several years now, but 2024 may witness significant reductions in funding. Governments looking to accelerate EV adoption have spent huge amounts of capital in the form of subsidies. Estimates indicate that China alone spent at least $57 bn from 2016 to 2022.

Countries struggling to hold off recessions in Europe have concerns over inflation, and growth in North America will push federal and state governments to rethink their allocations of capital if it could be better spent elsewhere. Countries in which EVs have already gained a significant share of the market are anticipated to be the first to cut their subsidies, with the expectation that the market will continue to grow without government help.

This occurred in Germany during late-2023 when the government put the brakes on the country’s subsidy scheme, ending it prematurely as of 17 December 2023. CRU anticipates that more countries will follow suit in 2024, particularly in countries where elections may shake up electrification ambitions.

6. First examples of Na-ion and LMFP batteries in EVs on the road

The battery market continues to make significant technological progress and 2024 will be a year in which some of this new technology is rolled out on a commercial scale. CRU anticipates sodium-ion and LMFP cells will be powering vehicles on the road. While these technologies will initially be constrained to the Chinese market, it will be a sign of bigger things to come for the global battery industry.

JAC’s Yiwei vehicles, powered by HiNa batteries, have already rolled off the production line in January, while BYD recently broke ground on its first 30 GWh sodium-ion cell plant in Xuzhou, China. Use of sodium-ion cells in stationary energy storage (the forecasted primary market for the technology) is also expected to grow rapidly.

Similarly, LMFP cells will be used towards year-end as major battery manufacturers, including CATL and Gotion, work to resolve some of the technical challenges with the chemistry