CRU’s metallic Wire and Cable service offers unrivalled independent market analysis on the supply and demand of copper and aluminium cables. The service also offers key insights into the requirements of the global construction industry, manufacturing as well as power generation, transmission, and distribution.

In this Insight, CRU takes a step back to review the key cable market developments of 2023. We also form our outlook for 2024 and identify the key trends which we anticipate will steer the market over the coming year.

2023 in review: Poor low voltage energy cable demand as construction struggled with high interest rates

High interest rates to combat high inflation were a defining aspect of 2023. The subsequent higher borrowing rates hindered construction investment and, thus demand, for residential property, supressing low voltage cable demand. Generally, non-residential and infrastructure projects fared better as government spend propped up demand. Additionally, infrastructure became the major lever of growth which was employed by China to support the struggling economy. Overall, power cable demand continued to remain resilient as these infrastructure and utility investments in green technologies continued despite wider slowdowns.

Over 2023, we saw greater levels of protectionism develop as nations responded to the supply chain weaknesses which were exposed during the Covid-19 pandemic. The US’s Inflation Reduction Act, the CHIPS and Science Act as well as the Infrastructure Investment and Jobs Act stipulated conditions which support domestic manufacturing. This paved the way for Europe’s response which was to launch its own Net-Zero Industry Act which aims to ensure that the region remains competitive in future clean technology manufacturing. Overall, domestic manufacturing of future-critical technologies has emerged as a key political focus.

Review of selected calls from 2023: Forecast versus reality

- China cable demand rebound from Q2: Though China’s demand did largely return, several areas of weakness were exposed – not least the highly leveraged property sector. Lower construction demand has been entirely compensated for by government investment via state-owned enterprises, though there are questions about the sustainability of this approach.

- Sustained high Cu price as underfunding of supply bites: Copper finished 2023 at $8,608/t, slightly up compared to the $8,375/t which it started 2023. Despite uncertainties, the opening of the Chinese economy and some supply disruptions – including cessation of copper supply from First Quantum’s Cobre Panama – lifted the price. European demand also appears to have reached a lower bound.

- Offshore wind installations to surpass targets: High interest rates have created a challenging financial environment which has impacted some investors in offshore wind projects. Several projects on the US East Coast are currently under renegotiation and will likely be delayed due to challenging financials. Installations in China progress expeditiously.

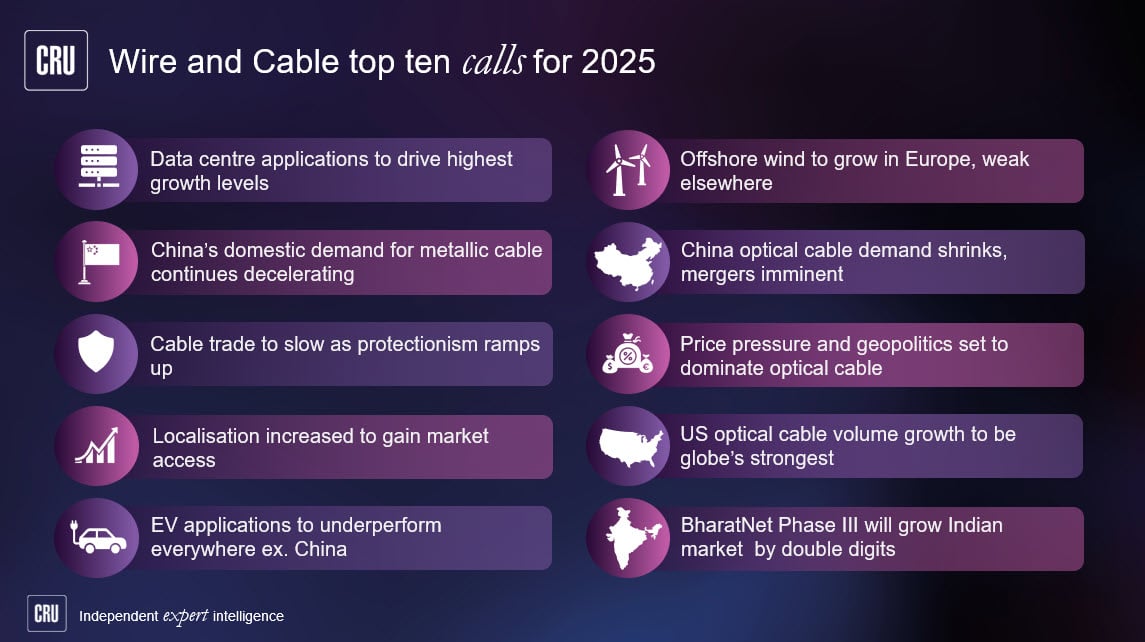

CRU Wire and Cable Top 10 Calls for 2024

CRU’s Top Ten Calls for 2024 are outlined below. These topics will be covered in detail throughout the year in our Wire and Cable Market Outlook service.

Click here or above to enlarge the image