Hedging “fashion” in the aluminium industry

Introduction

Hedging strategy reviews don’t tend to happen as often or as periodically as asset portfolio or marketing strategy reviews. They are rarely mandated to happen within a certain period and they are certainly not undertaken lightly, since any major changes to ongoing hedging practices inevitably have major consequences on the company’s way of doing business. Sometimes, the company’s size, business model and profile changes substantially over time, either through expansion of its activities or through M&A, prompting a necessary review of its risk management practices. Most often, however, the review is prompted by events that are common to multiple market participants, either “alarm bells” or outright “panics”.

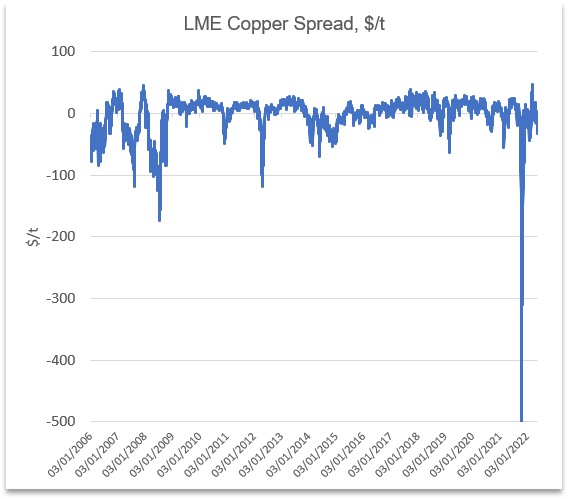

Outlier spreads are one example of a persuasive alarm bell. In copper, 2022 brought about a steep backwardation, which briefly sowed panic in the markets. With cash prices breaking records, it was not altogether surprising, but costly margin calls made much of the market take note.

LME Copper Spread, $/t

Aluminium LME Spread Cash to 3M price, $/t

Commentary

Aluminium tends to be better behaved as a market and better insulated from outlier spreads, with average monthly spreads between cash and 3M prices mostly sticking to a band of $40/t either side of flat. Nevertheless, with volatility pushing the forward curve into backwardation more frequently than anytime in recent memory and LME prices stubbornly high, price risk management has been a growing headache across the value chain. This adds to the constantly evolving picture in the physical market. Smelters face volatile alumina price index settlements, as well as fluctuating premia, while consumers have to deal with the concentration of profits upstream, high LME prices and volatile premia, while at the same time flattening demand reduces their ability to pass on increasing costs in highly competitive markets.

The “yo-yo” of spreads has led to some companies looking to lock in favourable spreads whenever possible as a way to retain some control. This is advisable for highly experienced hedging officers, who have both the mandate and the backing of their company leadership. In some cases, this has required amendments to the companies’ policies and permitted procedures, since such strategic hedging tends to blur the line between price risk management and speculation. Higher discretion in executing financial transactions in favourable situations is one way to re-assert control, as long as the policy around it is highly prescriptive and subject to regular review, to ensure changes in staffing do not result in such discretion ending up in inexpert hands. Also required is a careful re-assessment of the company’s risk appetite to ensure any additional discretion does not contravene with the agreed and stated corporate position on risk.

While reviews and changes to the financial hedging policies are opportune, they cannot resolve all the issues faced by growing companies, whether primary producers, manufacturers, traders, distributors or consumers. With the market expanding and companies growing in volume and product diversity, competition has led to pricing terms being adapted to increase the suppliers’ attractiveness to buyers. In many cases, expansion in traded volumes inevitably leads to more imperfections in matching physical and financial trades to complete the financial hedge. Flexible quotation periods and pricing terms make it extremely difficult to match each trade adequately and to group transactions together to reduce the cost of the hedge.

CRU’s advice for growing companies facing difficult reviews of their hedging policy and practices is therefore twofold. Firstly, we recommend careful, prescriptive design of discretionary limits for strategic hedging, so that the company can carefully monitor performance and avoid competence mismatches when staff turnover inevitably occurs. While locking in spreads and taking financial positions in favourable times is one way to manage spread risk, this should also not become a default tactic. Secondly, and most importantly, a regular review of physical transaction pricing terms and practices, with the aim of standardising them as much as possible, allows risk to be managed much more easily. With many companies growing and evolving continuously, regular consolidation of terms and practices allows the complexity of required hedging to be kept in check. For this, constant open communication and cooperation is required between the hedging, financial and commercial teams, and situating the hedging team close to both the commercial and treasury functions is crucial. CRU is on hand to provide advice on both financial and non-financial risk management methods.

Explore this case study with CRU