CATL has restructured the shareholding of two of its top executives. The official purpose is to better adapt to changes in the internal and external environments, further improve the company’s decision making, and promote the sustainable development of the company.

The restructure is interpreted to be an effort to mitigate CATL being designated as a ‘Foreign Entity of Concern’ (FEOC) under the US Inflation Reduction act (IRA).

A previous agreement combined the shares of Robin Zeng Yuqun, the founder, chairman and general manager of CATL, and Li Peng, the company’s vice chairman. Together they held 27.9% of the company.

Given Zeng’s position as a member of the Chinese People’s Political Consultative Conference – an advisory body to the Chinese government – and the greater than 25% shareholding in the business, CATL was in danger of being designated as an FEOC by the US IRA, under current interpretation of the rule.

As such, cells made by CATL’s overseas subsidiaries, with more than 50% ownership, were ineligible for IRA tax credits. The subsidiaries were also required to share details on complete rights to purchase, sell, and manage information, and give access to production details including the use of any relevant intellectual property or data that influenced production.

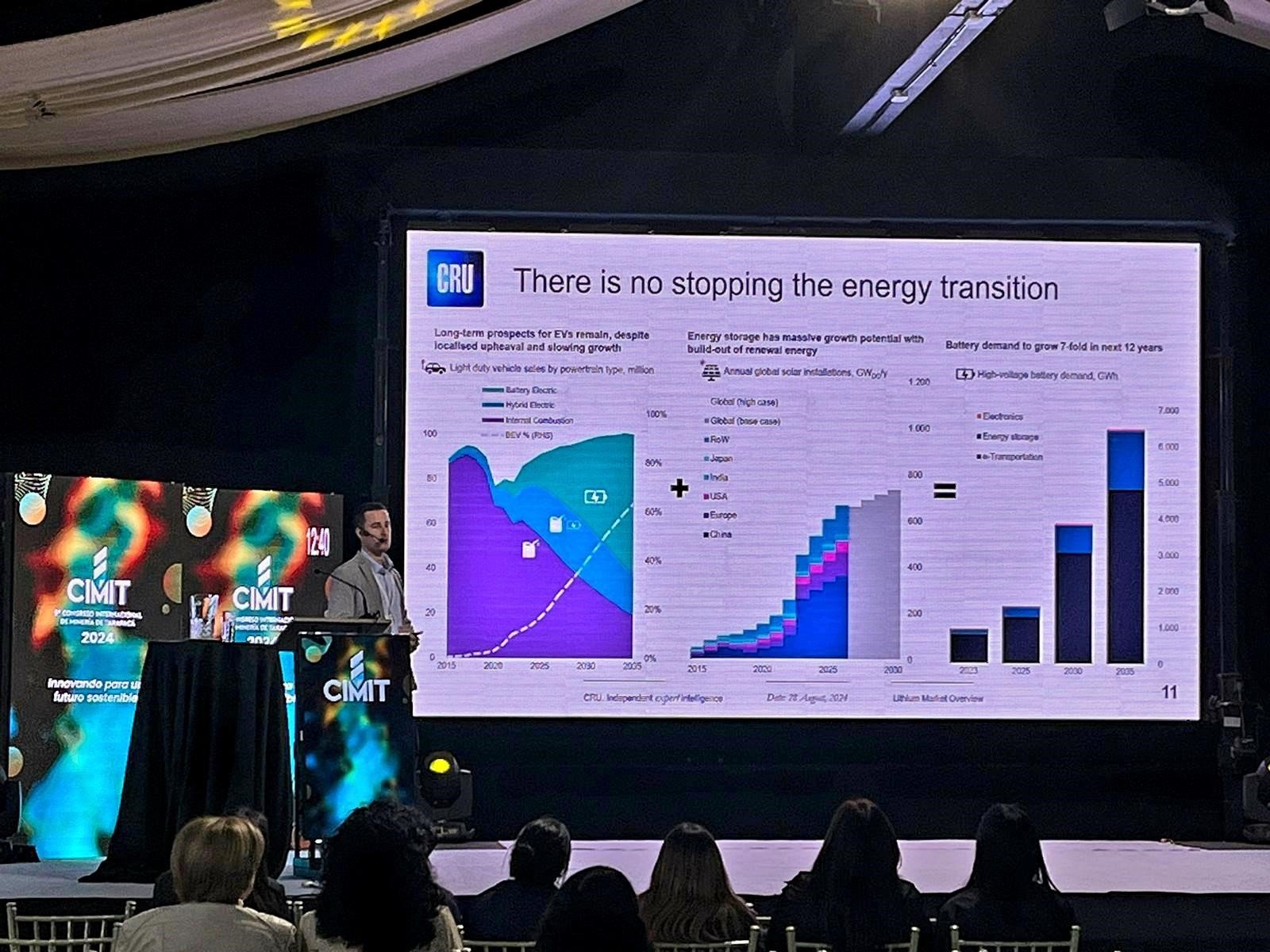

CATL dominated global cell production in 2023

Under a common and ‘at face value’ interpretation of the rules, the dissolution of the agreement means that CATL subsidiaries would no longer be designated as FEOC since Zeng’s shareholding will decrease to 23.5%, below the 25% threshold.

CATL is currently providing technical and manufacturing advisory for Ford, which is building an LFP battery plant in Michigan, using CATL’s technology. Another CATL joint-venture facility is being explored in Mexico. The company also exports battery cells from China for the US-built Tesla Model 3 and Mercedes’ US-built EQS and Sprinter models.

CATL is attempting to establish a production presence in the region. The company’s status as the largest battery producer globally, combined with tax credit eligibility could put its cells in high demand.

Gotion, Envision AESC, and EVE Energy are other Chinese cell makers looking to expanding their role in the fast-growing North American market.These companies will aim to mitigate the FEOC designation through legislative loopholes, but this may end up being a futile endeavour as US policymakers will seek to uphold the ‘spirit of the law’.

Certain elements of the US political scene are likely to consider amending the act or enacting other measures in response to Chinese companies taking a foothold in the region. This resistance to Chinese entry will remain regardless of the outcome of the US presidential election, but a Republican Party win would exacerbate it.