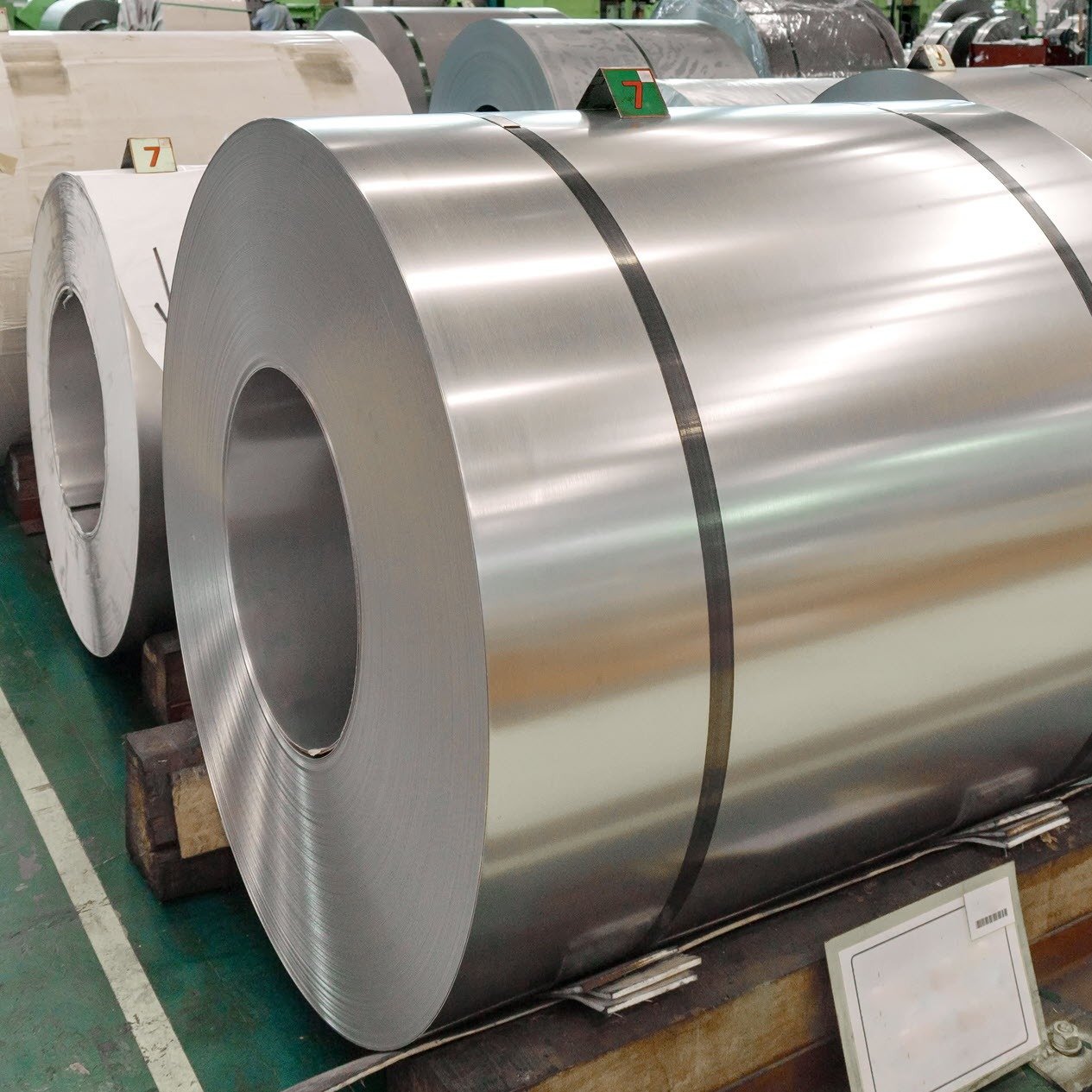

Steel

Elevate your steel strategy from ore to scrap and green steel

The steel industry is undergoing transformative change, driven by global shifts in demand, decarbonisation targets, and supply chain pressures. CRU offers comprehensive data and analysis, spanning the changing raw material mix to finished products such as rebar and hot rolled coil.

Our asset-level data, long-term forecasts, and sustainability metrics equip you to manage transitions in production processes, meet regulatory requirements, and adapt effectively to market dynamics and end-user demand shifts. With over 50 years of expertise, CRU is a trusted advisor and source of intelligence relied on to guide decision-making throughout the steel value chain.

'The CRU' - CRU's US Midwest Hot-rolled Coil Price Index

CRU supplies the leading index for steel prices in the US market. The US Midwest Hot-rolled Coil price, known as 'The CRU', is the trusted and established price benchmark used widely in the US steel market in domestic and global contracts.

Built on a strict, transaction-only methodology with data provision from steel mills and direct buyers, The CRU is the only true representation of spot market prices in the US steel industry.

CRU's industry-embedded community, Steel Market Update, surveys the market for sentiment, inventory and other indicators to supplement the deep insight our analysts provide our clients.

Our wider ferrous coverage follows a similar approach with data and analysis from price assessments to supply and demand forecasts.

Always data-led, our analysis is generated through methodologies that have been honed by industry experts over decades, helping our clients deliver the very best outcomes for their businesses.

Steel coverage includes:

Steel Prices

Get accurate steel price assessments and insights from CRU, covering metallics, stainless steel, raw materials, steel plate, and hot rolled coil, including The CRU.

Learn More

The CRU: US Midwest Hot-rolled Steel Coil Index

Get trusted hot-rolled coil price index data for CME’s HRC Steel futures. Stay ahead in the US steel market with reliable pricing insights. Explore now!

Learn More

Supply and Demand

We provide you with crucial consumption, production, capacity, trade, market balance and inventory data across the mining, metals, fertilizer and battery value chains.

Learn More

Forecasts and Scenarios

Navigate Commodity Markets with Timely Forecasts and Strategic Scenarios

Learn More

Asset Data: Supply, Costs, Emissions and Valuations

Our detailed insights into costs, production, emissions performance and valuations empower you to make informed decisions and drive your business forward.

Learn More

Macroeconomic and End-use Demand and Cost Drivers

International macroeconomic analysis empowering your decision making. CRU’s macroeconomic analysis enables you to make informed choices, mitigate risks, and seize opportunities across the global commodities markets

Learn More

Market and Industry Trends and Themes

Benefit from CRU’s extensive experience in analysing commodity market trends, dynamics and macro factors to make informed decisions

Learn More

Expert Interpretation of Market Data and Events

Benefit from expert market data and knowledge to identify key dynamics, assess implications, and stay ahead in the commodity market

Learn More

Specialist Analyst Support

Our experienced analysts, equipped with proprietary data and extensive networks, empower your decision-making processes and facilitate interactions with stakeholders.

Learn More

Economic and Sustainability Policy and Regulation

CRU offers a comprehensive suite of economic and sustainability insights that enable businesses to navigate the complex and rapidly evolving landscape of climate change and the energy transition.

Learn More

Sustainability and Emissions

CRU’s Sustainability Service offers insights on the sustainability value chain, emissions trends, carbon markets and the costs of renewable and alternative energy sources

Learn More

Clean Technologies

Stay ahead in navigating the sustainable energy landscape and make informed decisions with insights about clean technology.

Learn More

Asset Services

Cost, emissions and valuations data for mining, metals and fertilizer production sites globally. Benchmark and compare asset performance to inform your plans and decision-making.

Learn More

Asset Services

Solutions

Cost, emissions and valuations data for mining, metals and fertilizer production sites globally. Benchmark and compare asset performance to inform your plans and decision-making.

Learn MoreSign up to receive CRU's newsletter

Sign Up