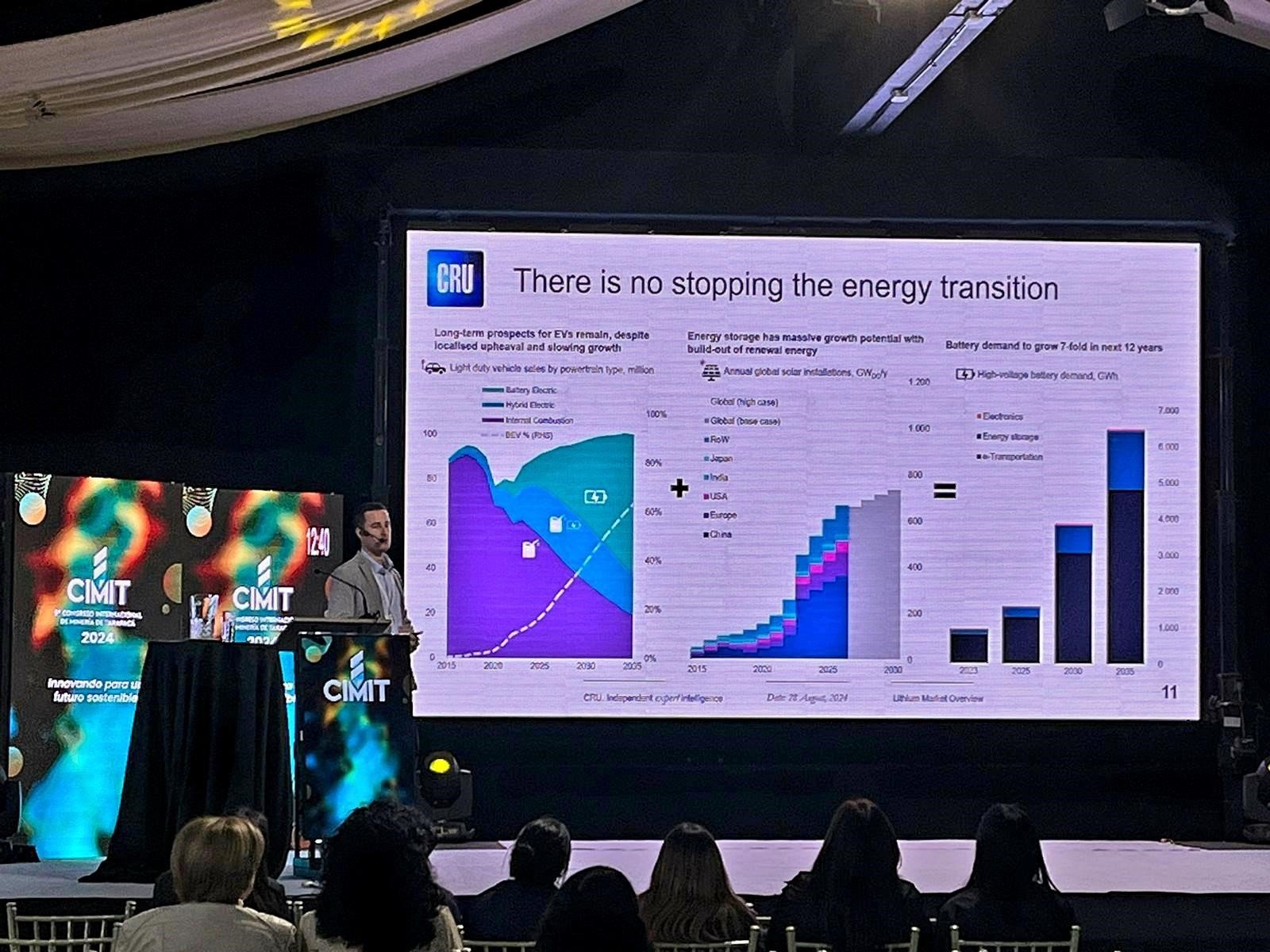

- While global battery electric vehicle (BEV) volumes continue to rise, the rate of growth has declined quicker than many expected, with the current penetration rate below the 13.1% observed in the last quarter of 2023.

- Economic factors, policy changes and a lack of affordability have exacerbated a slower BEV growth rate. However, there is a high degree of variation by market. For example, in China, EV sales have been boosted by the ongoing price war as automakers vie for market share.

- The slowdown has prompted some automakers to re-assess their EV investments and targets, opting to offer greater flexibility by expanding their hybrid lineups. Despite this, the long-term prospects for BEVs remain strong. More affordable models, greater competition and tightening regulations should support the transition, although adoption rates will vary by market

BEV volumes continue to rise while the growth rate has slowed

Concerns about a slowdown for BEVs have led some automotive manufacturers to scale back their electric vehicle plans. There is worry from some stakeholders that the shift to zero-emission vehicles might take longer than initially expected, raising doubts about achieving electrification targets. But has global BEV demand actually slowed down?

In the first four months of 2024, BEV sales increased by over 300,000 units y/y, up 13%, which is faster than the overall growth of light vehicle sales. This indicates that BEV sales continue to rise and gain market share on the global level.

However, examining the year-to-date global penetration rate of 10.1%, it is only slightly higher than the 9.3% recorded at the same time last year. The growth rate has decelerated more rapidly than anticipated, with the current penetration rate significantly below the 13.1% observed in the last quarter of 2023.

This decrease can be partly attributed to seasonal distortions, such as incentive changes, which typically boost year-end sales (pull-forward effect), followed by a subsequent decline (payback period). Analysing the BEV selling rate – also known as Seasonal Adjusted Annual Rate (SAAR) – reveals mixed results, with January and April above the moving average, while February and March were below it.

Lack of ex. China affordability has influenced the slowdown

The challenging economic climate, with higher interest rates impacting vehicle pricing and affordability, has hindered BEV growth. BEV prices generally exceed those of equivalent internal combustion engine (ICE) vehicles, leading to notable effects on private BEV demand in several markets. However, pricing in China hasn’t been an issue, given that BEVs are typically cheaper than traditional ICE vehicles, making them more appealing to price sensitive buyers.

Affordability concerns, along with charging and range anxiety, and changes in subsidies and incentives in key markets, have weakened consumer sentiment towards BEVs. This has led to a rise in demand for other propulsion types, such as hybrids. For instance, Germany – Europe's largest BEV market – has recorded a 11% YTD, y/y decline in BEV sales following the withdrawal of the German EV subsidy. In the US, new rules for the IRA 30D tax credit have excluded some EVs from eligibility, negatively impacting BEV demand.

In response, several automakers have offered incentives, such as price discounts, especially among pure-play EV companies. However, some legacy automakers have been reluctant to follow suit due to strategic reasons and profitability concerns. Supply bottlenecks have also affected BEV growth, with delays in sourcing key parts and components leading to production downtimes and fewer BEVs being delivered.

There is disparity in growth between markets

While BEV demand has softened in some markets, it has accelerated in others. In China, new product launches, model updates and intense competition have driven aggressive price cuts, boosting EV sales as automakers vie for market share. A newly introduced scrappage scheme will provide a further stimulus. In France, BEV demand has been bolstered by various tax incentives and subsidies.

Sales have surged in many emerging markets, including ASEAN and Latin America, fuelled by rising imports from mostly Chinese automakers offering more affordable BEVs. However, it is important to note that in most of these markets, growth has originated from a relatively low base.

Automakers have cut back on BEV targets and investments

The slowdown in BEV growth has precipitated a wave of automakers reassessing their BEV adoption targets and cutting back on production plans. While some have reaffirmed their commitments, many have scaled back their plans, opting to offer greater flexibility by expanding their hybrid lineups. A number of automakers have formed partnerships to develop and launch BEVs, spreading costs and mitigating risk.

Some automakers have reportedly lobbied policymakers to relax emission standards, zero-emission vehicle mandates, and ICE bans due to market conditions and strategic reasons. For many legacy automakers, their BEV technology is not yet as competitive as that of leading players, and they continue to haemorrhage cash in having to maintain two value streams in parallel. They rely on revenue from their existing ICE businesses to fund their BEV operations.

Consequently, the slowdown in BEV growth may be seen as a relief for some legacy automakers, providing them more time to enhance their BEV capabilities and competitiveness. Meanwhile, several pure-play BEV manufacturers have reduced their sales targets for this year.

There is no way back to the ICE age

Despite the recent slowdown, the long-term prospects for BEVs remain strong. The substantial investments and political commitment to the transition towards e-mobility by both the automotive industry and policymakers make a reversal unlikely. Factors such as the introduction of more affordable models, cost reduction in batteries and other vehicle components, increased competition, tightening emission targets, and long-term zero-emission vehicle and net-zero goals should support the transition to BEVs.

However, there will continue to be a difference in adoption rates between markets. Meanwhile, in the short to medium term, expect some fluctuations in growth.