The CRU

The CRU is the trusted and established steel sheet benchmark

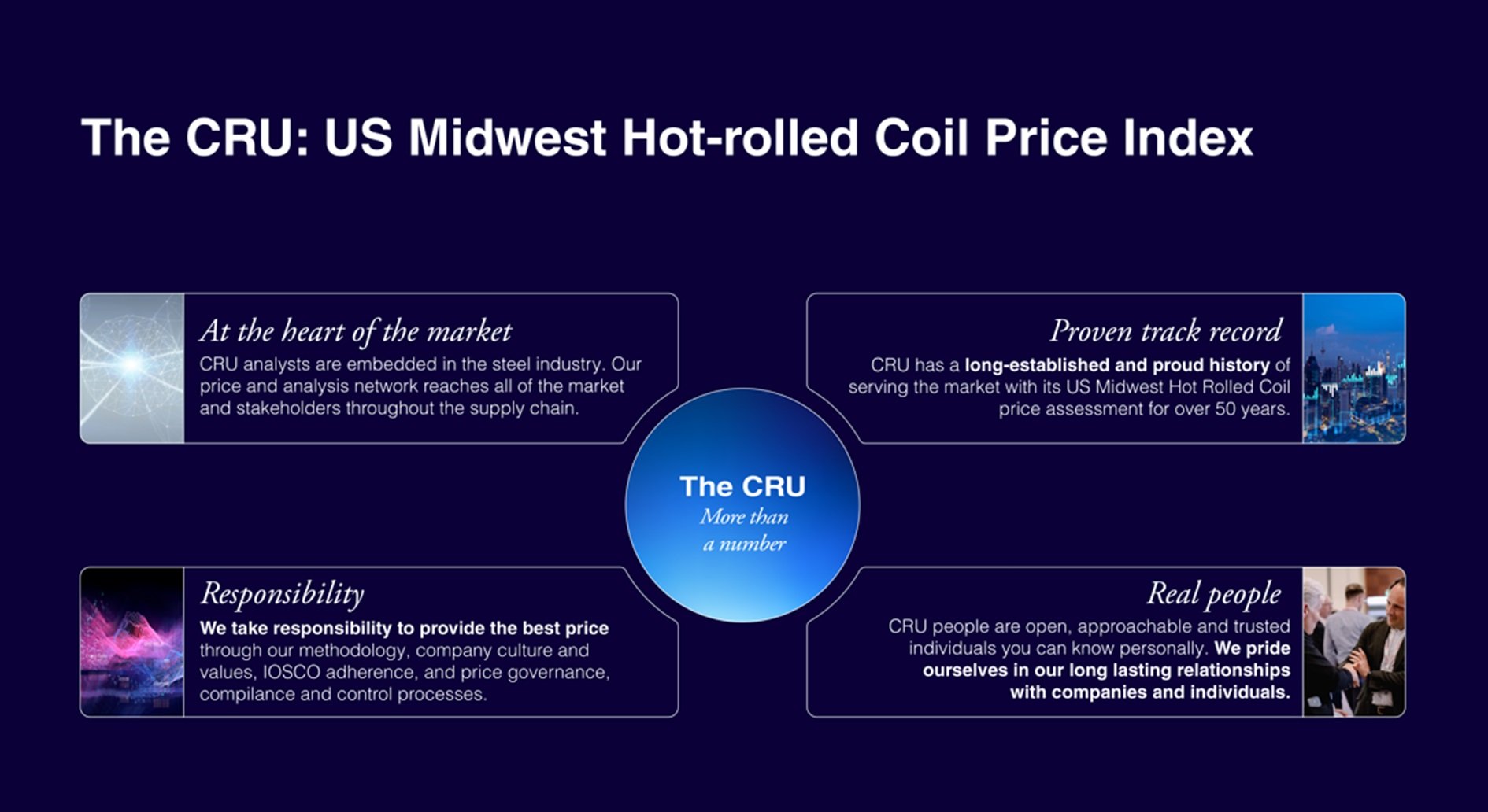

Proven through contract-settlement volumes as well as independent research, CRU's US Midwest Hot-rolled Coil Price Index is the most widely-used price benchmark in the US steel market. The sole transaction-only sheet and plate price assessments in the US market, The CRU helps our customers across the steel supply chain to manage their businesses, by enabling them to protect margins, hedge physical positions and mitigate price risk.

More than a number, The CRU is underpinned by the strength and reputation of our steel prices and analysis, together with our robust methodology and price governance processes. Entirely independent and free from outside influence, CRU is upheld by a foundation built upon relationships, experience, responsibility, and our people.

What makes The CRU unique?

-

The CRU hot-rolled coil index is unique because of its transaction-only methodology.

-

The index is made up of spot transactions from the prior week and reflects real spot business. It does not include bids, offers and opinions, or transactions based on contracts.

-

The CRU Midwest hot-rolled coil price is published consistently every week, including holidays.

-

As well as being the most widely-used index in the physical market, the weekly hot-rolled coil price indices make up the basis for the settlement of the CME futures contract.

- Data providers receive access to the Data Provider Dashboard with exclusive insights into weekly volume trends.

Data providers contributing to the index include the majority of US steel mills as well as dozens of service centers and manufacturers. Invested in the quality of the index, their contributions ensure that the index reflects the reality of the spot market.

If you are interested in becoming a data provider, please contact estelle.tran@crugroup.com

The CRU: The trusted and established steel sheet benchmark

We wanted to confirm our belief that CRU’s hot rolled coil price – published every Wednesday in CRU’s Steel Sheet Products Monitor, and known by many as ‘The CRU’ – is the leading steel benchmark in the US market.

Learn More

Point of distinction in pricing

CRU has been built on strict methodologies using first-hand data and information to deliver trusted price assessments, steel market forecasts, analysis, costs services and global industry events.

Our market and price analysis work is largely informed by proprietary models and models developed in-house – an approach distinguished from any other PRA. CRU's steel price assessments are supported by our deep understanding of commodity market fundamentals, our expert macro enconomic analysis and data, and comprehensive view of supply chain operations for the steel industry.

Proud history serving the North American market

CRU has a long-established and proud history of serving the market with its US Midwest HRC price, The CRU. This is reflected in over 40 years of HRC price data, starting back in January 1980 with our first US Midwest price assessment at $326 /s.ton.

The CRU is used in the settlement of CME’s US Midwest Domestic Hot-Rolled Coil Steel (CRU) futures contract and was the first index to have its data providers and methodology audited by a third party. Enabling clients to effectively hedge against price volatility and to manage price risk, CRU-settled contracts are now used further afield in Mexico, Asia and other markets seeking to export to North America.

CRU Steel coverage:

Steel Prices

Get accurate steel price assessments and insights from CRU, covering metallics, stainless steel, raw materials, steel plate, and hot rolled coil, including The CRU.

Learn More

Steel

Our steel market data and intelligence help you unlock competitive advantage.

Learn More

Stainless Steel

Based in London, Beijing and Mumbai, CRU’s Stainless Steel team brings you global market analysis, forecasts and price assessments along the supply chain.

Learn More

Forecasts and Scenarios

Navigate Commodity Markets with Timely Forecasts and Strategic Scenarios

Learn More