Steel MENA Insight series: Part 1

The Gulf Cooperation Council (GCC) region plays a relatively minor role in the global steel hot rolled flats production at present. However, this region has recently been in the spotlight due to several greenfield flat steel investments announced by major steel makers. In Part 1 of this Insight series, we explore how these investments in GCC will shape flat steel supply and demand in this region.

Regional demand is growing strongly

Recent economic growth in the GCC region has been aided by the governments’ strong push towards infrastructure spending, with an aim to diversify away from oil-driven demand growth.

Saudi Arabia has announced several large infrastructure projects as part of its Vision 2030 plans, such as The NEOM and Red Sea Project. Trojena – a city being built as part of the NEOM project – secured hosting rights for the 2029 Asian Winter games. More recently, Saudi Arabia has been awarded hosting rights for the 2034 FIFA World Cup which will see the country taking up new infrastructure projects.

UAE also announced a number of construction projects while Qatar outlined ambitious plans as part of its National Vision 2030. This flurry of construction projects means that regional steel demand will be strong during the second half of this decade. In our latest Steel Sheet Market Outlook and Steel Plate Market Outlook (request a Steel demo here), we forecast that total steel hot rolled flat products demand in the GCC will grow at a healthy CAGR of 7.1% during the 2025–29 period.

Domestic longs output has grown but flats remain imported

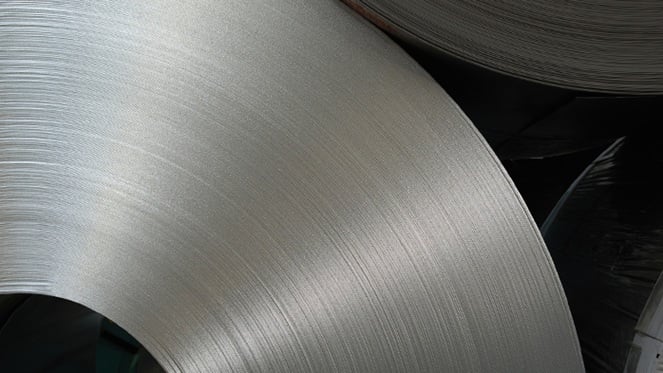

Until now, domestic steelmaking investments in the region have been largely for long products. These investments have greatly reduced import dependence of the GCC in the last decade. On the contrary, lack of new flat steel investments meant that imports kept on growing to feed incremental demand.

With growing demand, the investment focus has now shifted to flat products. Several plans have been announced, which include the following:

- Oman: Vulcan Green Steel’s 5 Mtpy DRI+EAF hot strip mill in Duqm under construction, with phase 1 (2.5 Mtpy capacity) expected to commence operations in 2027.

- Saudi Arabia: Essar Group announced 4 Mtpy DRI+EAF hot strip mill in Ras al-Khair industrial complex, with construction likely to begin in 2025 and operations likely to commence in 2028.

- Saudi Arabia: Aramco-PIF-Baosteel announced 1.5 Mtpy DRI+EAF plate mill in Ras al-Khair as part of the Vision 2030 projects, which is likely to commence operations in 2029.

While there had been some delay in the proposed investments by Essar Group and Aramco-Baosteel, we expect these investments to materialise in the later part of this decade as possible reduction in interest rates would ease financing conditions and help secure the required funding.

GCC steel production costs are moderate, but imports can be cheaper

Capacity in the GCC typically leverages low-cost natural gas and consequently, in terms of technology, is dominated by DRI-EAF steelmaking route. This is also the case with the proposed projects. Production costs of existing assets are in the mid-to-low range on the global scale, which is relatively favourable but not necessarily best in its class. This region typically imports flat steel from China and India, and the BF-BOF mills – which cater to this import demand – are lower-cost, at least on an EXW basis which is evident in the chart below taken from CRU’s Cost Analysis Tool, which shows the cost of steelmaking for different mills across the world.

Trade policy is likely to nurture domestic capacity

In the last decade, when longs capacities came online, GCC countries implemented additional import tariffs on long products and local content rules that served to boost the value proposition of domestic production. Similarly, as soon as new coated sheet investments came up in the GCC, safeguard duties were implemented to restrict imports and support domestic producers. Saudi Arabia, which currently has the region’s sole HR coil production, also has a 15% duty on HR coil imports. As the new hot rolled flats capacities come online, we expect regional governments to continue this pattern of implementing protective measures, which restrict imports and nurture domestic producers.

Similarly to how it occurred for longs, we expect that the import dependence for flat products in the GCC region will fall sharply in the future.

Lower emissions intensity may facilitate growth in exports

With steel production being based on natural gas, the CO2 emissions footprint of GCC steel capacity is lower than BF-BOF assets elsewhere. The data taken from CRU’s Emission Analysis Tool which models carbon emissions across the steel value chain clearly shows that GCC mills fall in the first quartile global steel emission curve. This is significant for buyers in regions where emissions have a cost – most notably Europe. New GCC capacity could, therefore, also find export opportunities if it is able to leverage this factor. Such opportunities could exist at different stages of the value chain – not only finished steel but possibly also intermediate products (note: only CRU clients can access this Insight). Indeed, Jindal’s investments in both Vulcan Green Steel in Oman and plate re-roller Vítkovice Steel in Czechia is an explicit recognition of this.

To conclude, the upcoming hot rolled flat products capacity in the GCC region will displace imports that have been increasing steadily to meet the growing demand in the region. However, as the cost of steelmaking in these new assets is not going to be as cheap as its counterparts in China and India, protectionist trade policies will be needed to nurture this capacity. On the other hand, the emission profile of these assets will be conducive to exports when carbon costs come into picture.

Continue to follow our Insight series for detailed discussions on this topic in upcoming segments.