Asset Services

Make the best-informed decisions with next-level asset intelligence

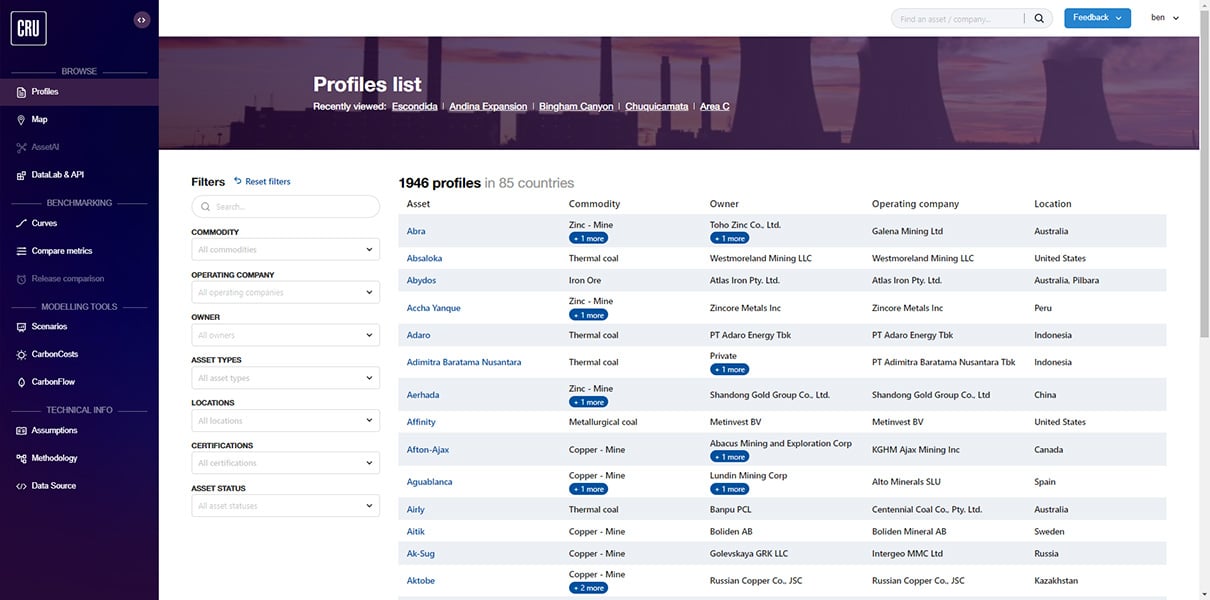

With global coverage of over 4,500 mining, metals and fertilizer sites, CRU's Asset Services provide the most comprehensive view of granular asset intelligence industry-wide.

Underpinned by CRU's 50+ years of expertise delivering world-class market intelligence, our asset data supports informed assessments at the asset, company and commodity levels.

Accessed through the web-based Asset Platform, CRU's Asset Services provide deep insight into the costs, emissions, valuation and overall performance of individual assets and of the industry more generally.

Comprehensive intelligence in a centralised Asset Platform

Unlock insights and gain clarity

The Asset Platform is your gateway to comprehensive and reliable asset data and intelligence – all centralised in one place. With its advanced analytics tools, you can swiftly extract the insights you need for effective decision-making.

Coverage spans from base metals and battery materials, steel and steelmaking raw materials, the aluminium value chain, fertilizers, ferroalloys, energy and precious metals.

Whether you are looking for data for market analysis, asset benchmarking, sourcing decisions, project financing or trading and investment allocation, we can expertly inform your decision-making.

-

Access asset intelligence in one centralised, web-based platform.

-

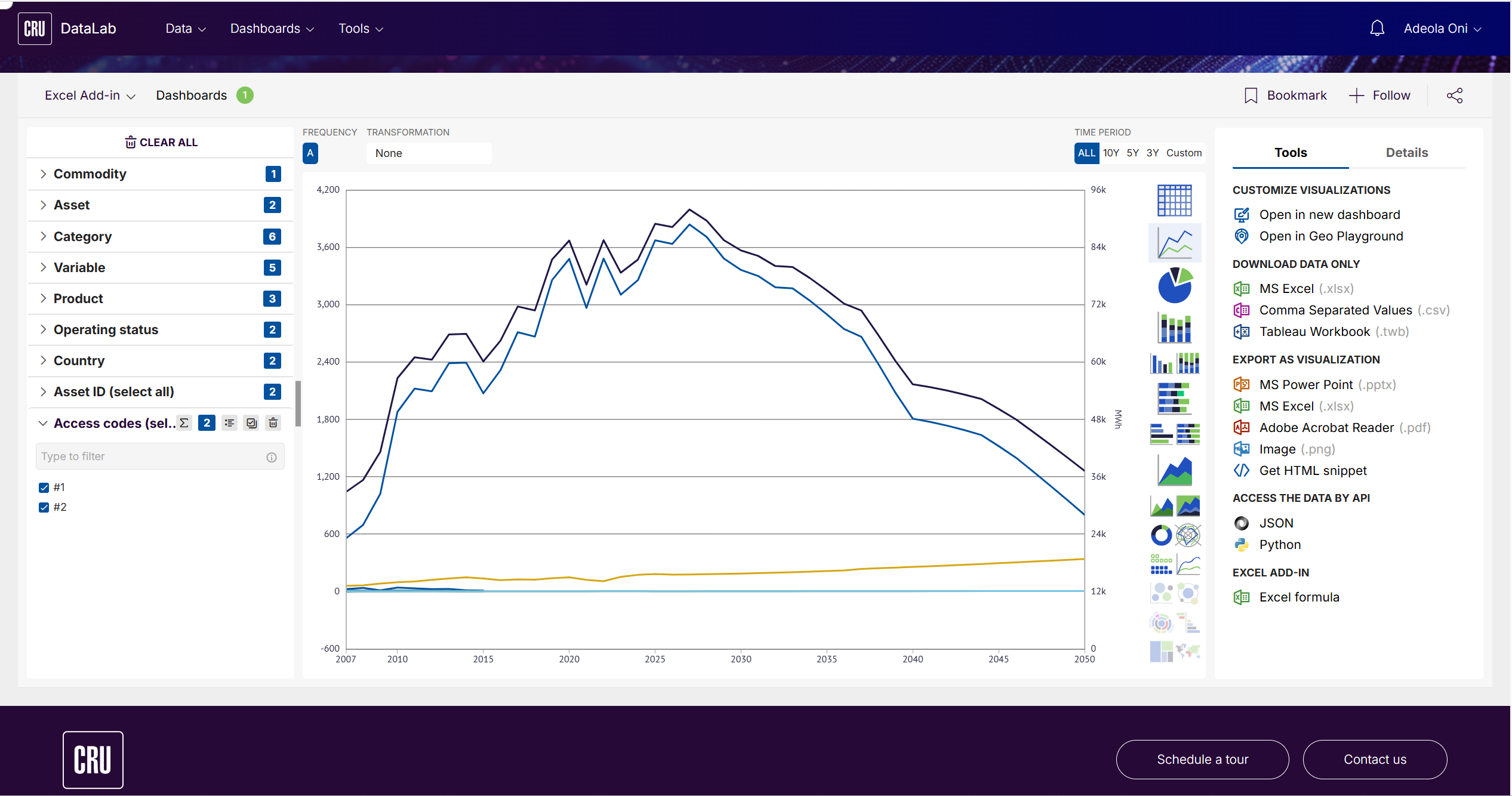

Interrogate, model and analyse data to evaluate asset performance. Instantly see the detail behind the data with drill-down views by stage breakdown.

-

Build asset curves to view costs, emissions and valuation performance.

-

Compare sites to benchmark costs, Scope 1, 2 & 3 emissions and production volumes.

-

Use the web-based scenario analysis tool to run efficient modelling, with no need to download and maintain outdated desktop cost models.

Advanced analysis and custom views

Leverage the Asset Platform's dynamic analytics tools to get to insights – fast.

Advanced yet easy-to-use tools like the scenario analysis tool make it quick to analyse data and build custom scenarios, while data can be exported and integrated seamlessly into in-house systems and applications for enhanced data accessibility.

-

Benchmark Key Parameters: Evaluate and benchmark costs, emissions and production volumes to compare site performance and understand future potential.

-

Create Custom Scenarios: For fast and efficient modelling using the web-based scenario tool. Models can be easily rerun using new data to compare results.

-

Assess Emissions: Use the CarbonFlow tool to provide a view of carbon emissions for the full value chain for steel or aluminium by combining different assets to assess amalgamated Scope 1, 2 and 3 emissions.

Make informed investment decisions

Assess new investment opportunities or analyse portfolio performance using CRU's comprehensive project and operating asset valuations, together with extensive cost datasets, to gain a clear and reliable understanding of asset value.

CRU's valuation data currently provides accurate assessments for 800 of the most important sites globally covering copper mines, nickel mines, lead and zinc mines, giving access to:

- Pre-tax cashflows

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Profitability Index (PI)

- Payback period

Seamless data integration for maximum efficiency

Data can be seamlessly exported from the Asset Platform into in-house systems using the API or Excel Add-in features powered by the platform's integration with CRU DataLab.

Cross-organisational data sharing can be supported with an enterprise license.

Get a personalised walkthrough

Request a DemoWhy choose us?

CRU's services are underpinned by 50 years of world-class market knowledge and our expert team of global analysts. We understand the different needs of diverse industries and tailor our solutions to provide maximum value.

Whether you are a raw materials producer, financial institution, policy maker, industry service provider, or commodity trader, our comprehensive Asset Services are designed to meet your specific requirements and deliver insights to achieve your goals.

Commodity Producers

Learn More

Financials

Learn More

Policy Makers

Learn More

Industry Service Providers

Learn More

Commodity Traders

Learn More

Related solutions

Related commodities

Aluminium

For over 50 years, CRU has provided independent, data-led coverage of the aluminium value chain.

Learn More

Battery Materials

Our data, analysis, and expertise covers every step of the battery supply chain, driven by our unrivalled understanding of battery and raw material markets.

Learn More

Chrome

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More

Coal

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More

Cobalt

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More

Copper

Market analysis, price assessments and forecasts, and costs and emissions analysis tools, providing data and insights through subscription services.

Learn More

Energy Commodities

CRU helps organisations understand the energy transition in the power sector, delivering insights and a wealth of data on power generation and capacity, using traditional thermal coal to cutting-edge solar PVs

Learn More

Ferroalloys

Comprehensive market analysis and forecasts, price assessments and cost services across ferroalloys worldwide.

Learn More

Gold, Silver, Platinum and Palladium

We provide market analysis for gold, silver, platinum and palladium, as well as price forecasts and cost analysis tools, giving you access to data and insights through subscription services.

Learn More

Iron Ore

We provide market analysis for gold, silver, platinum and palladium, as well as price forecasts and cost analysis tools, giving you access to data and insights through subscription services.

Learn More

Lead

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More

Lithium

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More