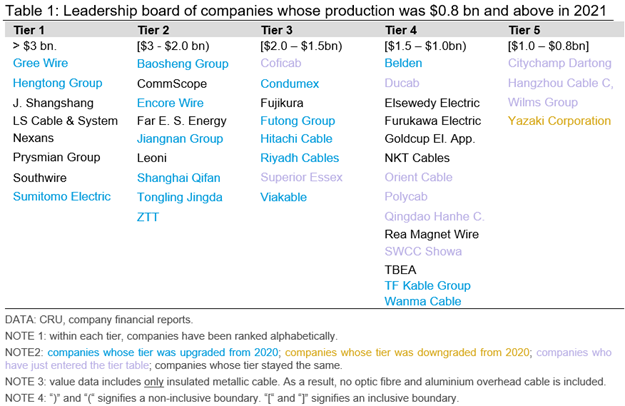

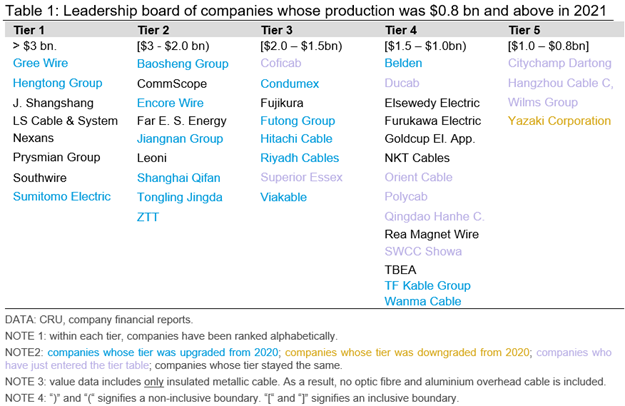

CRU’s annual leadership board has reclassified 28 out of the 43 companies covered, as 18 companies changed tier, and a further ten were added.

Among the added companies, nine of them are new entrants to the leadership board, while SWCC Showa returned to the list after being dropped in 2020. Only one company, Yazaki Corporation, was downgraded. The number of cable companies covered also increased, with most of this increase occurring in Rest of World (RoW) countries such as Turkey and Thailand.

Explore this topic with CRU

Tier leadership board reclassified 28 out of 43 companies

2021 marked the post Covid-19 economic recovery which stimulated demand for cables and an increase in prices. The LME 3-month annual average copper and aluminium prices have soared from $6,182 /t and $1,728 /t in 2020, to $9,294 /t and $2,485 /t in 2021, respectively. This led to a rise in revenue for many companies globally, hence, we see several companies moving up in the tiers, and several other companies being added to the leadership board.

The leadership board, as presented below, is comprised of five tiers, with the lowest one starting with an annual insulated metallic cable production value of $0.8 bn. In this edition, 28 companies have seen a change in their standings. 17 companies have moved up, with four of them, Sumitomo Electric, Hitachi Cable, Viakable and Belden returning to their pre-2020 standings. Ten companies were also added, with only SWCC Showa not being a new entrant to the list. Only one company, Yazaki Corporation, has seen a drop in its tier, while no company has been dropped off from the leadership board this year.

Three new companies join Tier 1

Tier 1 includes all companies whose 2021 annual insulated metallic cable production exceeded $3 bn. In this update of the leadership board, three new companies were added to this tier. Among them, Gree Wire and Hengtong Group are new joiners, while Sumitomo Electric returned to this tier after losing its position in 2020. Hengtong’s impressive growth momentum led to its further upgrade from Tier 2 to Tier 1, building on strong growth since 2019.

Companies such as Jiangsu Shangshang, LS Cable, Nexans, Prysmian Group, and Southwire remained within the Tier 1 category. All of them saw a strong increase in their revenues derived from cables. Overall, these companies have experienced an average of 33% growth in 2021, and surpassed their 2019 results by an average margin of 13%.

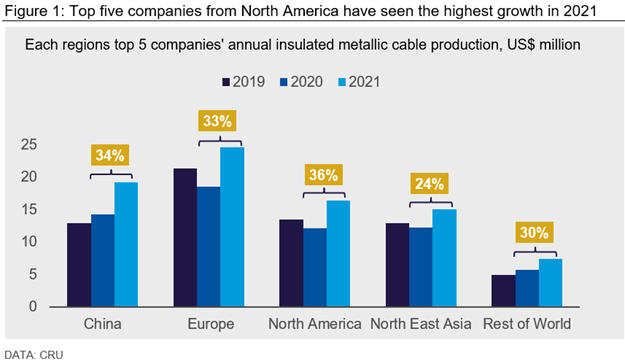

Cable-derived revenue growth is not equally distributed

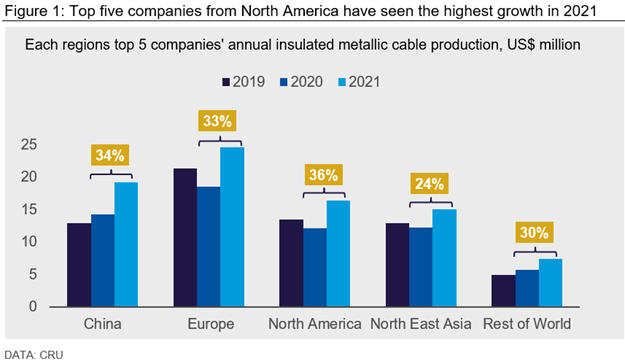

The revenues derived from cable sales soared across the globe in 2021. However, this growth has not been equal between different regions. When looking at cable-derived revenues of the five biggest companies of each region, North America has seen the largest increase in revenue between 2020 and 2021, with an average 36% y/y growth. As seen in Figure 1, this growth rate is largely a recovery from weaknesses in cable derived revenues in 2020 due to Covid-19-related economic downturn.

All four companies that have returned to their pre-2020 standings – Sumitomo Electric, Hitachi Cable, Viakable and Belden – are located in North America and Northeast Asia. This is reflective of the significant drop in revenue that these companies experienced during 2020, with top five companies in North America and Northeast Asia experiencing -11% and -5% y/y declines, respectively. Meanwhile, all but two companies that have risen above their 2019 standings in this edition are either based in China or RoW due to meaningful market consolidation in these regions. In 2021, the top five companies in China and RoW represented 23% and 14% of all cable-derived revenues, up from 22% and 12% in 2019, respectively.

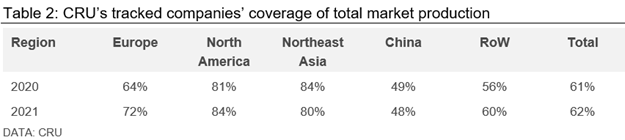

Coverage increases in RoW and Europe regions

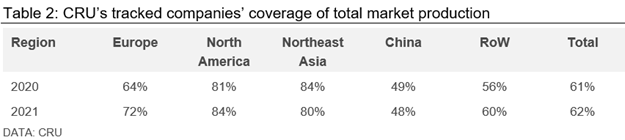

Cable companies, which CRU tracks, cover a significant share of the total cable market. Table 2 outlines the percentage of the regional market included in CRU’s database of tracked cable companies. Overall, North America and Northeast Asia have the greatest level of coverage due to the smaller number of large-scale companies that dominate these markets. By comparison, China and RoW have a lesser degree of coverage as these markets are comprised of a larger number of smaller cable producers operating in a highly-fragmented market.

In this edition, CRU has expanded the number of companies analysed to create the leadership board by adding 15 new companies. Most of these companies are located in Europe and RoW regions. Among all the countries, Turkey has seen the biggest number of company additions, with four new companies being included in this edition of the leadership board, resulting in a grand total of 13 Turkish companies. In terms of the global wire and cable industry, the companies included in this edition cover 62% of the total global wire and cable sales in 2021, which represents a 1% increase from the 2021 edition of this report.

Methodology

For the top global wire and cable manufacturer analysis, CRU’s estimates are based on a strict definition of insulated metallic wire and cable. This means we have excluded sales of bare overhead conductor, copper and aluminium wire rod as well as bare wire, fibre optical cable, accessories, engineering, procurement and construction services, and any other non-cable related business. All data shown is CRU’s own estimate, rectified through rigorous primary and secondary research. We welcome feedback from our subscribers, and if you require more information regarding this study, please contact us directly.

Explore this topic with CRU