The Democratic Republic of the Congo’s (DRC) dominance in cobalt mine supply means the upcoming presidential and parliamentary elections pose a potential risk to the market. In previous election cycles, civil unrest and political policies have impacted mine supply growth and Congolese exports. Incumbent president, Félix Tshisekedi, whose policies have placed emphasis on gaining better terms on historic mining contracts, will be hoping to see off a number of political challengers.

Author Thomas Matthews

Battery Materials Analyst View profile

All eyes on the DRC as election looms

With less than a hundred days until the elections, players in the cobalt value chain will be keeping a watchful eye on events in the DRC. Despite the rapid emergence of Indonesian Ni-Co laterite production, over 70% of global supply in 2023 still comes from the DRC. Thus, cobalt pricing is intrinsically linked to developments in the country. Of the five highest cobalt metal price events in the past 50 years, three have been linked to disruptions in the DRC – stemming from political, social or geotechnical issues.

Historical precedent for disruption

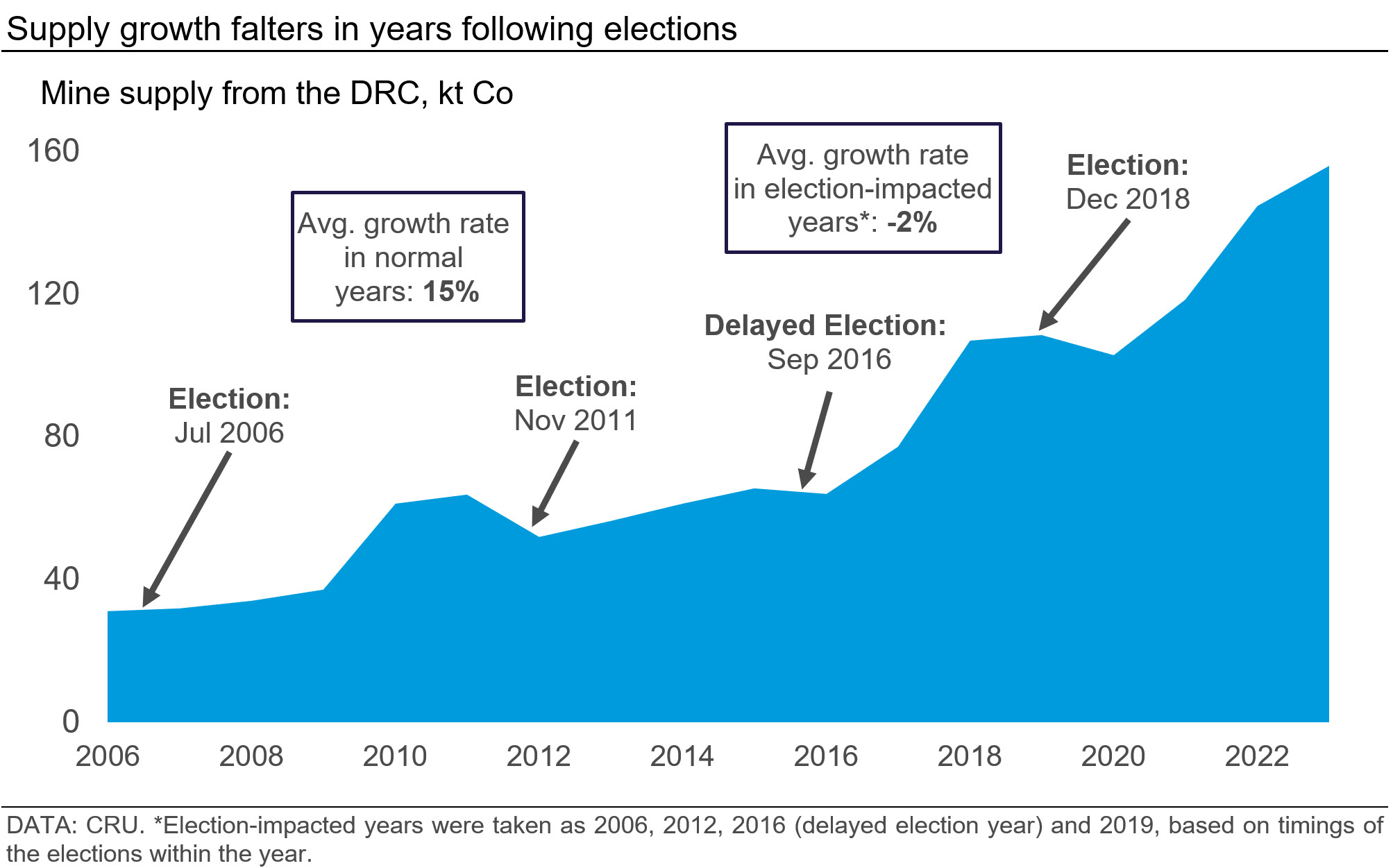

These elections will be the fourth under the current constitution, with previous elections in 2006, 2011 and 2018, as well as a postponed election in 2016. While the political environment of the DRC has somewhat calmed in recent times, the four previous election events have each brought some level of disruption and unrest to the country. Given the DRC’s dominance of mine supply, such disruption naturally impacts the cobalt market, bringing stagnating or declining mine supply growth in election-impacted years. In these years, mine supply declined on average at a rate of 2% y/y – in stark contrast to other years between 2006 and 2023 where growth averaged 15%.

In the short term, exports from the DRC to China – by far the largest market for cobalt – highlight the influence of events in the central African nation. Congolese exports were negatively impacted by major events associated with the 2016–2018 election period. There were major protests in September 2016 when the original elections were suspended, with a new election date set for late 2017. July 2017 was marked by further protests after it was announced that elections would not be held until late 2018, in addition to unrelated acts of violence in the Great Kasai Region.

The enactment of legislation can also be expected in the leadup to, and aftermath of, elections. A new mining code was adopted in March 2018, which included a new “super profits” tax rate, also allowing cobalt royalties to be increased to 10% if deemed a “strategic substance”. After the election in February 2019, a temporary export ban was put in place on cobalt and copper concentrates, aimed at increasing domestic refined metal output.

Influential president set to be challenged by several candidates

Incumbent president Félix Tshisekedi was recently officially backed for re-election by his ruling coalition party, Sacred Union, for elections that are scheduled to take place on 20 December. One of the candidates standing against Tshisekedi will be Martin Fayulu, leader of the Lamuka coalition. Fayulu stood against Tshisekedi in the contested election of 2018, and has consistently denounced intimidation, bias and a lack of transparency in the election process.

It is unclear whether Fayulu, or any other candidate, would take a similarly involved role in shaping the countries mining policy. Since his ascendance to the presidency in 2018, renegotiation of ‘unfair’ mining contracts has been high on Tshisekedi’s agenda, including the multibillion-dollar Sino-Congolais des Mines (Sicomines) agreement. Indeed, this sentiment is believed to have been a major driving force behind the Gécamines-CMOC dispute that resulted in an export ban at one of the world’s largest cobalt mines, Tenke Fungurume. More recently, it was reported that more than 20 mining licences had been suspended by the DRC government, with assets owned by Eurasian Resources Group (ERG) believed to be some of those affected. This move comes after an August report that the government was seeking to take control of some of ERG’s assets, in response to a perceived lack of development.

What happens next?

In the worst-case scenario, sustained periods of unrest, suspension of mining licences, and political intervention would negatively impact mine supply. Under CRU’s base case scenario, DRC mine supply is expected to grow 15% y/y in 2024, driving a substantially oversupplied market. However, if the country’s mine output was, instead, to shrink by 2% y/y (the average of previous election-impacted years) then the market would be pushed into a supply deficit. This could lead to a market shock, pushing cobalt sulphate and metal prices back up above $20 /lb, as they were for the majority of 2021 and 2022.

While a disruption is not expected, producers and traders have been building inventories ahead of the vote, in both South Africa and China. This is primarily due to weak demand, but it would lessen the impact of lower-than-expected production. Whatever happens, over 65% of mined cobalt will be sourced from the DRC for at least the next five years. Events in the country will continue to be an important consideration for the market in the medium term, despite the rapid growth of Indonesian supply.

Explore this topic with CRU

Author Thomas Matthews

Battery Materials Analyst View profile