The United Autoworkers reached deals with all three major auto manufacturers in late October, and steel mill lead times have quickly pushed into 2024. In this Insight, we examine what the supply situation looks like now and how it may shape up moving into next year.

Author Alexandra Anderson

Analyst View profile

Author Ryan McKinley

Senior Analyst View profile

Production fell on outages but will find support in 2023 Q4

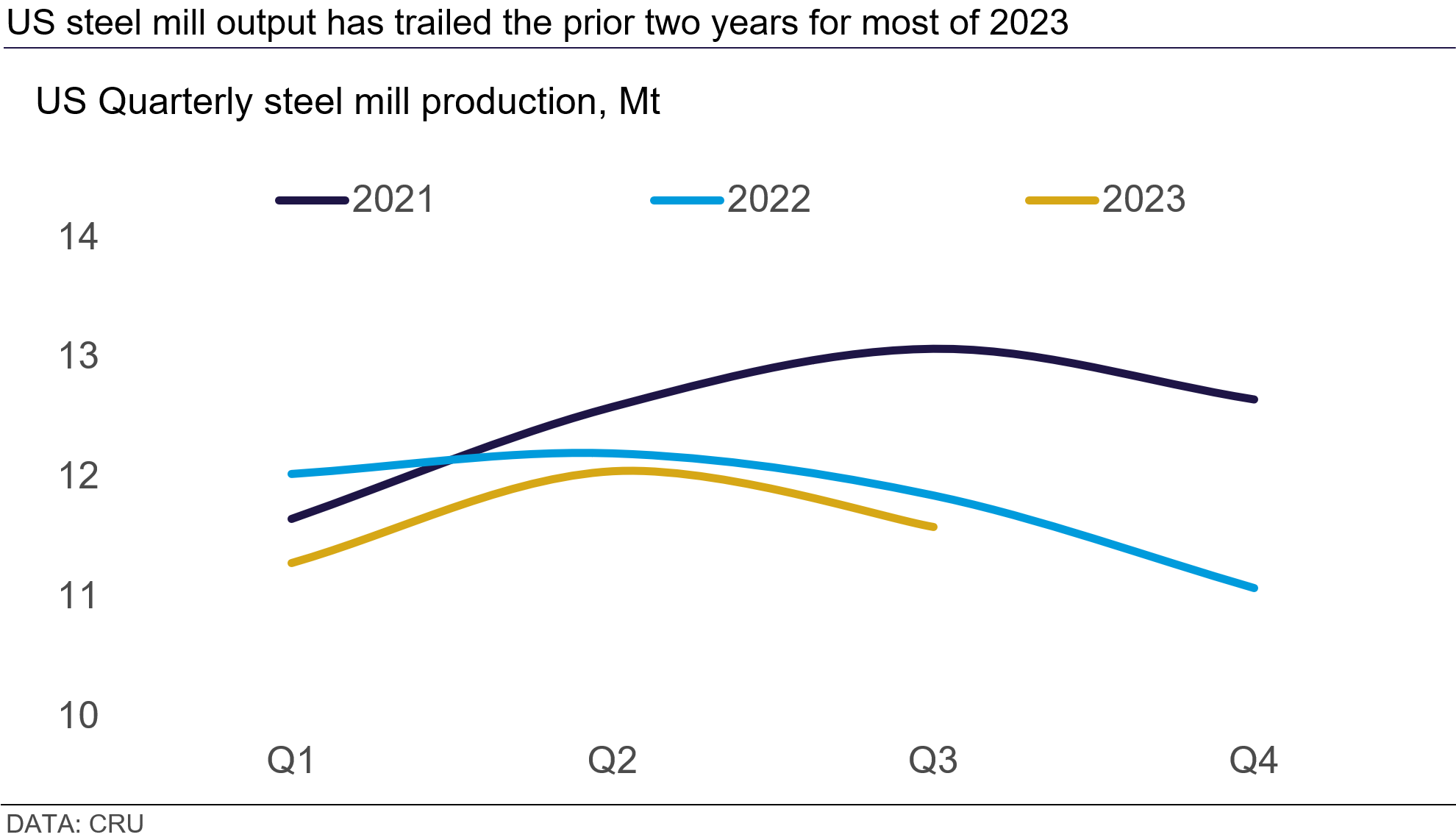

After a slow start to 2023, US raw steel output began to track with prior-year levels in the second quarter of this year. We have started to see a seasonal decline in late Q3 and early Q4, but this was largely due to maintenance outages or the recent automotive worker strike. With the majority of these stoppages now over, we expect this trend towards prior-year levels to continue, if not accelerate into 2024.

At the beginning of 2023, steel mill output was trending lower than the two years prior. In part, this was due to expectations of decreased demand that kept capacity utilisation rates relatively low, but also because US Steel’s Gary Works No.8 blast furnace was idled at the end of 2022. New capacity expansions that had been scheduled to ramp up at the beginning of the year were also slow to do so. However, by 2023 Q2 it was apparent that demand was much better than initially anticipated. US Steel brought its Gary Works furnace back online, and some of the capacity expansions finally began producing. In all, y/y output improved from its low of -6.2% in 2023 Q1, and we expect this number to turn to positive growth in Q4.

Outages are over and large orders from buyers will keep mills busy

US mills underwent about 1 Mt worth of annualised planned maintenance outages during the time of the strike, and when including unplanned maintenance outages and idled furnaces, this number was closer to 3 Mt in total. The autoworker strike is now over, as are these outages, which means mills are unlikely to extend maintenance outages further and this should help support steel production.

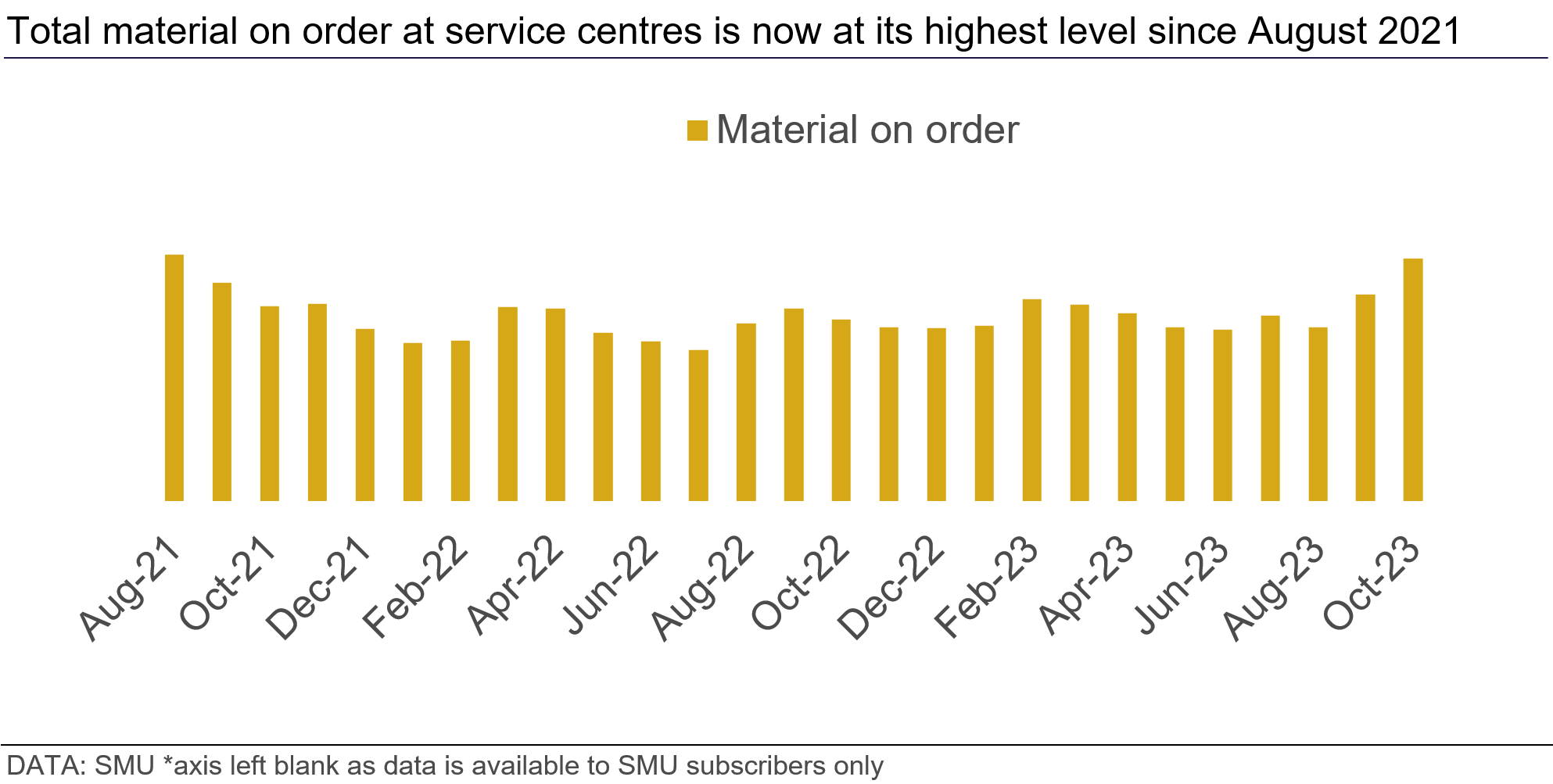

On top of this, service centre shipments of steel sheets rose 6% y/y in October, while shipments YTD are up 3.2%. Based on these October shipments, inventory at the end of last month represented 52.6 shipping days of supply, near historical levels. While inventories had been in balance with outbound shipments, service centres carried out very large speculative purchases in August and September as mills looked to replace some of the potential volume lost due to the automotive strikes.

Evidence of these orders is seen in the following chart for material on order. This end-October metric is higher than what was during the prior two months and is at its highest level since August 2021. The result of these orders allowed lead times to extend, which created the need for buyers to secure more material. Due to this uptrend of new orders, we expect that mill output will increase 5% y/y in 2023 Q4 followed by another ~2.5% between 2024 Q1 and 2024 Q2.

Mills are targeting higher output for new capacity in 2024

In its recent earnings call, Steel Dynamics said its mill in Sinton, Texas, is targeting a 70% capacity utilisation rate by the end of 2023, compared to a 50% rate currently and for much of the year. It will also ramp up to 80% in 2024. At the same time, Nucor has said its expansion at its Gallatin facility is fully running, and North Star Blue Scope’s expansion appears to be running as well. While US Steel idled its Granite City Furnace B (1.3 Mt /y) in September and has not announced when, if at all, it will be brought back online, the other three additional capacity additions will offset this by ~4 Mt /y. This means that overall production capability will be much higher over the near term. In total, we project that steel sheet output will grow by 3.6% y/y in 2024.

Higher finished steel production will require more scrap

Sluggish mill demand, coupled with high inventories, have kept scrap prices under pressure throughout 2023 Q3. While planned mill outages and the autoworkers’ strike reduced buying even further, slowing inbound flows to scrap yards allowed for a drawdown in obsolete scrap supply. Although demand is traditionally lower during the end of the year, tightening supply should buoy scrap in the meantime. Entering 2024, restocking early in the year will continue to support the market. The continued increase in EAF production, both for steel sheet and long products, will mean a fundamental rise in demand for prime grades, shredded scrap, and, subsequently, ore-based metallics like pig iron. As such, more mills have acquired scrap assets, while some shredders are exploring new technologies to reduce residuals. However, widespread adoption of high-strength magnets and other such technology may be limited due to their high cost. Ultimately, we expect that domestic supply will tighten further in the medium term as scrap consumption in EAF production will rise ~14% from 2024–2028.

Domestic output set to rise in the USA

US steel sheet production this year has trailed behind 2022 levels, but we expect to see a ~5% y/y rise in 2024 Q4, followed by another ~2.5% increase across 2024 Q1 and Q2. We base this on the end of outages, the auto strike concluding, and new capacity production targets. Risks to this view are unplanned production disruptions keeping output levels low or if mills with new capacity are unable to meet their production targets. Another variable is the potential sale of US Steel’s assets and what this means for a restart at Granite City. However, barring these developments, we forecast that output will rise y/y in 2024.

Explore this topic with CRU

Author Alexandra Anderson

Analyst View profile

Author Ryan McKinley

Senior Analyst View profile