The £73 /MWh (real 2012) maximum bid price proposed by the UK Government for Allocation Round 6 (AR6) of the CfD (Contracts for Difference) auction in 2024 is at the upper end of the required bid range, as suggested by a recent CRU Insight. This is 66% above that offered in AR5 earlier this year when no offshore wind developers bidding occurred. This bid price equates to ~£100 /MWh in today’s prices, ~£16 /MWh higher than September day-ahead prices. However, as discussed in the aforementioned Insight, this bid price does not necessarily cover the full cost of offshore wind. In many cases, competitive bidding will be predicated on expected higher revenues in the future, dependent on higher carbon prices driving up power prices even higher than £100 /MWh.

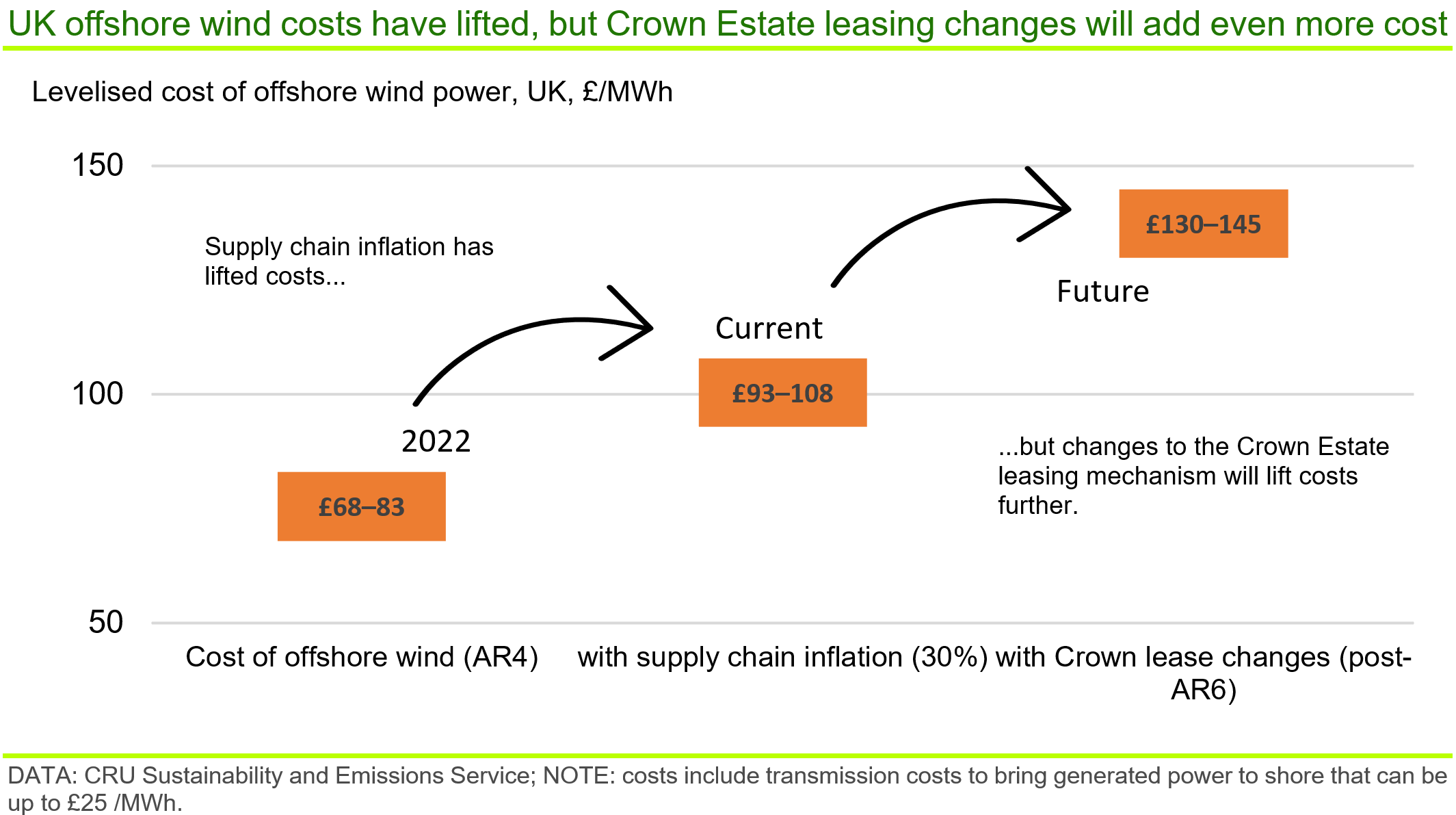

Assuming 30% supply chain inflation, we believe costs of offshore wind lifted from £68–83 /MWh last year to £93–108 /MWh currently, depending on distance to shore and location of landfall. However, construction and transmission costs at the lower end of this range will not be widely accessible as proposed wind farms will typically be further from shore and reach landfall in higher cost generating zones. Our analysis shows that, for wind projects with costs towards the upper end of the current cost range, a bid price of £73 /MWh requires the carbon price at ~£165 /tCO2 (real 2023) in 2040 – when the CfD contract expires – to lift power prices to ~£120 /MWh (real 2023).

Therefore, while raising the bid price was a necessary first step to ensure success of the next auction, the UK Government would do well to reaffirm its commitments to climate targets in order to provide the needed certainty that carbon prices will rise sufficiently in the future.

Further out, the new Crown Estate leasing mechanism is expected to add up to ~£35–40 /MWh to the costs of offshore wind. Thus, at the same 2040 carbon price of ~£165 /tCO2, the maximum bid price would need to rise to ~£110 /MWh (real 2012), or ~£150 /MWh in today’s prices, to incentivise bids from these projects in future auctions.

CRU provides independent, coherent analysis of new energy technologies supported by transparent assumptions. If you need credible inputs for your business planning, contact us, we’ll be happy to discuss our work and how it might help you.

Explore this topic with CRU