To revive the sluggish property sector and bolster consumer confidence, the PBoC significantly ramped up its targeted stimulus measures in December 2023 through its Pledged Supplemental Lending (PSL) programme. This RMB350 bn (~$50bn) injection marks a crucial shift, prioritizing low-cost funding for the “Three Major Projects”. We expect that this targeted approach, unlike past broad-based measures, will achieve desired growth without re-inflating asset bubbles. However, the success of this strategy hinges on the effective allocation of funds and avoiding overreliance on the PSL as a substitute for necessary structural reforms.

Henry Hao

Principal Economist View profile

China turns up the dial on “Three Major Projects”

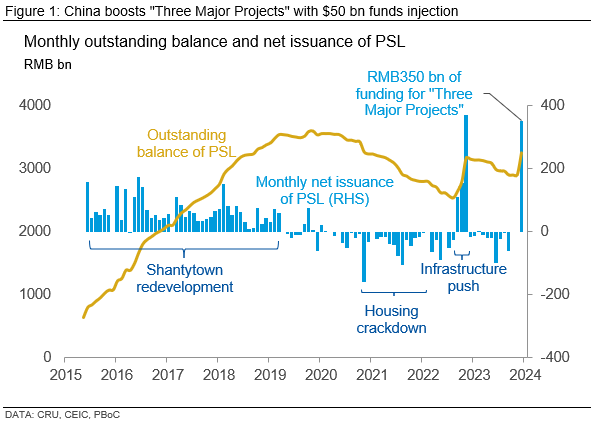

The People's Bank of China (PBoC) injected RMB350 bn (~$50 bn) of low-cost funds into policy banks in December, signalling a ramp-up of financing for affordable housing, urban village redevelopment and dual-use infrastructure projects, the so-called “Three Major Projects”. This marks an increase in support, with the outstanding balance of PBoC's Pledged Supplemental Lending (PSL) programme surging to RMB3252 bn ($459 bn) by December, up from RMB2902 bn in November (Figure 1).

This targeted stimulus aims to bolster the Chinese economy in 2024, particularly by addressing two key concerns: a multi-year property sector downturn and persistently weak consumer confidence. The PSL programme serves as a crucial tool in China's toolbox, allowing for direct and effective funds transmission to sectors deemed vital for growth.

Affordable housing and infrastructure at heart of stimulus program

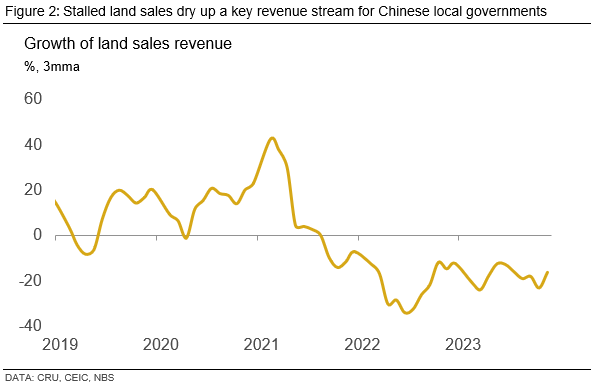

Markets have anticipated that the PBoC will leverage this cheap funding to drive public housing construction, easing the pressure on a sluggish property sector. In our China Macro Monthly, we reported that China plans for a phased RMB1 tn injection aimed at affordable housing and urban village renovation programmes, and the PSL lending forms part of this. The expansion of the PSL and other quasi-fiscal tools can be also considered as a potential substitute for other major funding sources of local government such as land sales revenue that have been decreasing in recent years (Figure 2).

Looking ahead, we still expect the PBoC to utilise traditional monetary policy such as reserve requirement ratio cuts to further bolster the economy. It is still unclear how large the Chinese stimulus will be overall. The announcement of the official budget deficit target for 2024 during the Two Sessions meeting in March will also be important. After December’s Central Economic Work Conference, market participants expect the official budget deficit for 2024 to exceed 3%, anticipating a more accommodative fiscal stance.

PSL is a tool with a double-edged past

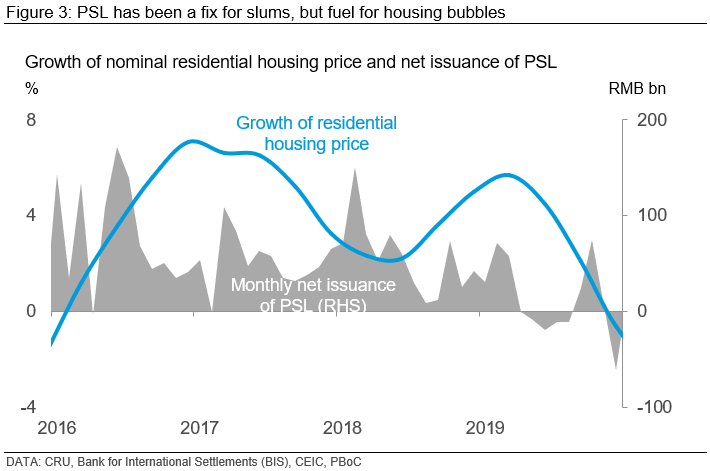

The PSL programme, however, boasts a controversial history. Its previous heavy use between 2016 and 2019 did help redevelop shantytowns and halt the property slump that began in 2015, but it also helped fuel unsustainable home price bubbles, drawing comparisons to “flood-like stimulus” and “quantitative easing with Chinese characteristics” (Figure 3).

Recognizing these past concerns, the PBoC adopted a more targeted approach in 2022 and used the PSL to inject RMB740 bn into infrastructure projects through policy banks. This targeted deployment helped to drive substantial infrastructure investment in the final quarter.

In December, a policy bank further reinforced the PSL’s focus on the “Three Major Projects” by extending a RMB10 million loan to support an affordable housing project in Fujian province, demonstrating the concrete application of PSL funds. The low interest rates on these loans, at 2.4%, below both policy and commercial lending rates, underscore the government's commitment to facilitating affordable housing construction and urban village redevelopment.

Balancing growth and stability

China's targeted stimulus through the PSL programme represents a deliberate effort to support key sectors without resorting to broad-based monetary easing. This approach aims to address immediate economic concerns while minimizing spillover effects like asset bubbles. Nevertheless, the success of this strategy hinges on effective allocation of funds and avoiding excessive reliance on the PSL to compensate for structural reforms. As China navigates a complex economic landscape in 2024, its judicious use of targeted stimulus tools like PSL will be crucial in achieving desired growth without compromising long-term financial stability.

If you are keen to hear more about our views on China and global economy, please refer to Global Economic Outlook and/or get in touch with our CRU economists:

Henry Hao: Hangwei.Hao@crugroup.com

Alex Tuckett: Alex.Tuckett@crugroup.com

Explore this Topic with CRU

Henry Hao

Principal Economist View profile