In the next month, we forecast carbon prices will be stable with upside risks. More nuclear reactors are to come online, and renewables will stay strong, but gas and coal prices are set to rise with seasonal demand.

Wind and hydro strong, but potential to underperform

Wind and hydro have been exceptionally strong throughout November in Europe. Strong winds are expected to continue for the next two weeks, but there is a risk this will not persist into late- December. Additionally, although reservoir levels are high, only average rainfall is forecast next month and this may not be sufficient to maintain the current hydro output. The impact of solar performance is minimal at this time of year. Overall, our base case view is that renewables will be stable in December, but there is upside risk to the carbon price if they underperform.

Nuclear performs well in November, despite French outages

Nuclear output in Europe performed well in November even with French nuclear underperforming. The French nuclear fleet had four unplanned closures in November, with nuclear output much lower than last month. More reactors are planned to come online in December, so the outlook for nuclear is good. Nuclear will have a marginal impact on EUA demand but with downside risks.

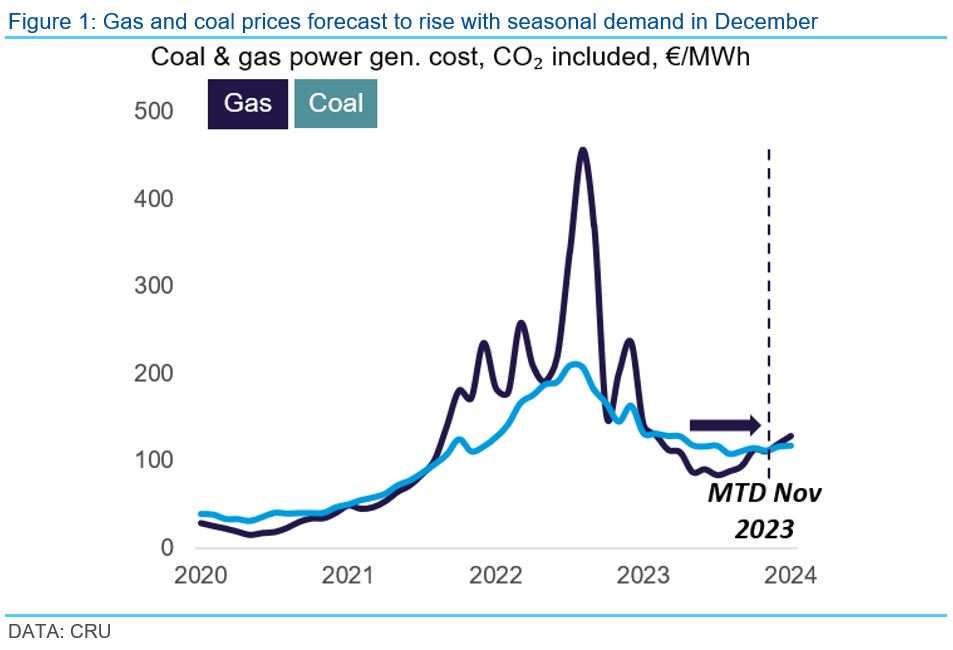

Both gas and coal prices will rise in December

Gas and coal prices both dropped slightly in November, but gas became more competitive with coal, and gas use picked up slightly. Both gas and coal prices are forecast to rise in December with seasonal heating demands and there should be limited gas-to-coal switching. EU gas storage is full, which should limit any gas price increases, but there is upside risk to EUA demand if gas prices outpace coal.

Industrial output to remain weak in December

Industrial output will not pick up in December. The industrial sector is still struggling and the Eurozone is nearing recession. Electricity demand has been up due to seasonal heating demand, but energy demand from the industrial sector will remain low. We expect industrial output will have a marginal differential impact on EUA demand in December.

If you want to hear more about carbon market developments and our short-, medium- or long-term carbon price forecasts that are provided as part of CRU’s Sustainability and Emissions service, please email us at sales@crugroup.com, we’d be happy to discuss this with you.

The cut-off date of the data is 20 November 2023.

These and other economic developments that impact commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. Experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to discuss markets one month on from the invasion of Ukraine. The webinar is available to watch on-demand here.

Explore this topic with CRU